What Trading Channels Really Show (It’s Not What Most Traders Think)

They’re mapping rotation, not predicting price

Home » What Trading Channels Really Show (It’s Not What Most Traders Think)

I’ll be honest, I used to think channels and trend lines were a bit rubbish…

I mean…

- It’s all done by eyeball

- You can make the trend line look hugely different depending on how you draw it

- And is any fund really watching a trend line?

But then I realised something…

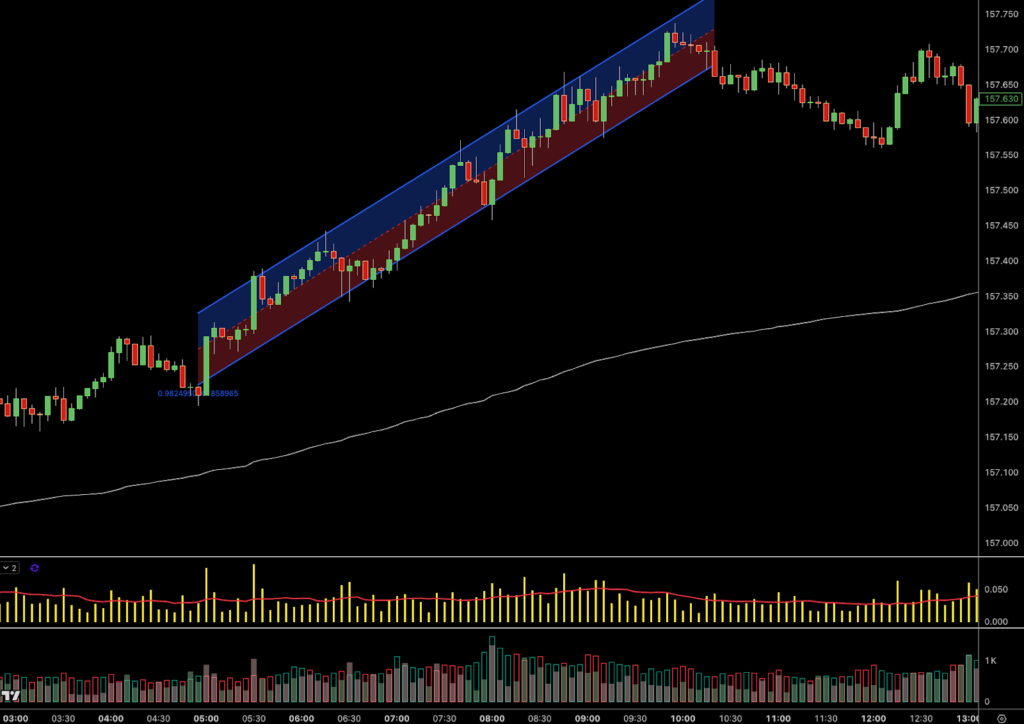

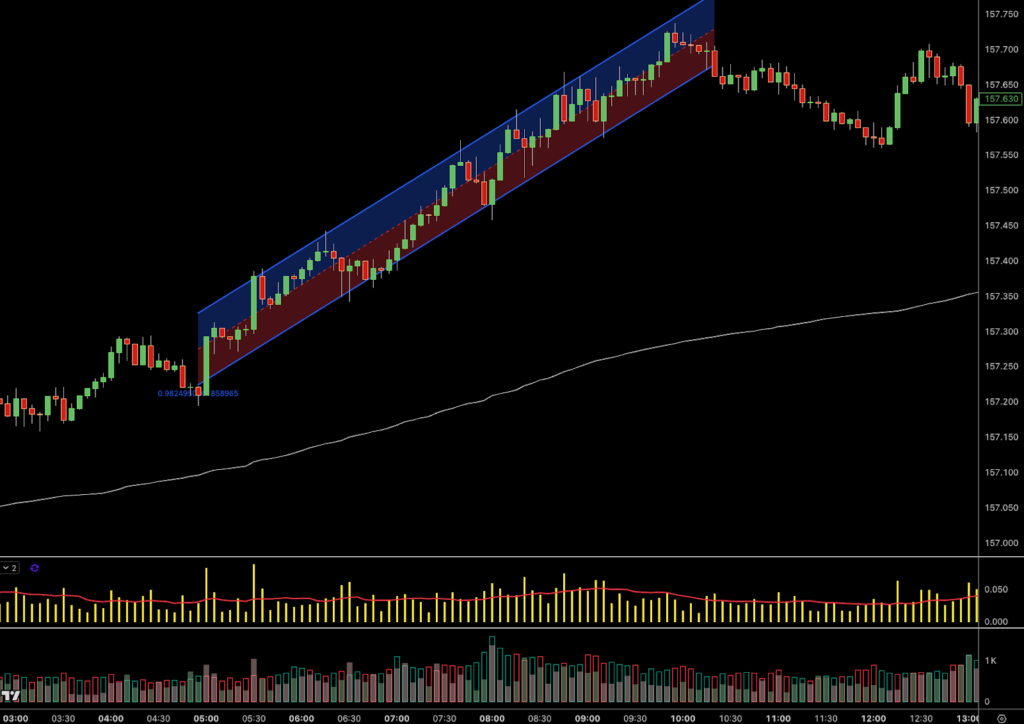

ROTATION MAPPING

Trend lines aren’t just lines that run across lows or highs.

They are mapping the natural rotations of the market.

200 pips up… 120 down

210 pips up… 100 down

195 up… 100 down

Do that long enough, and you get a nice trend line or channel on your chart.

Not because the line is magic, but because the market has rhythm.

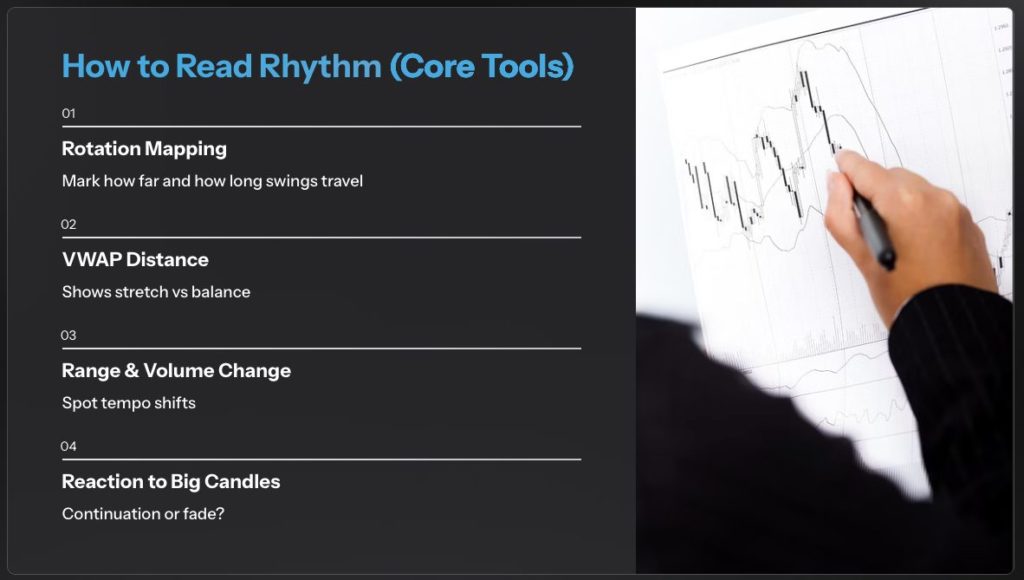

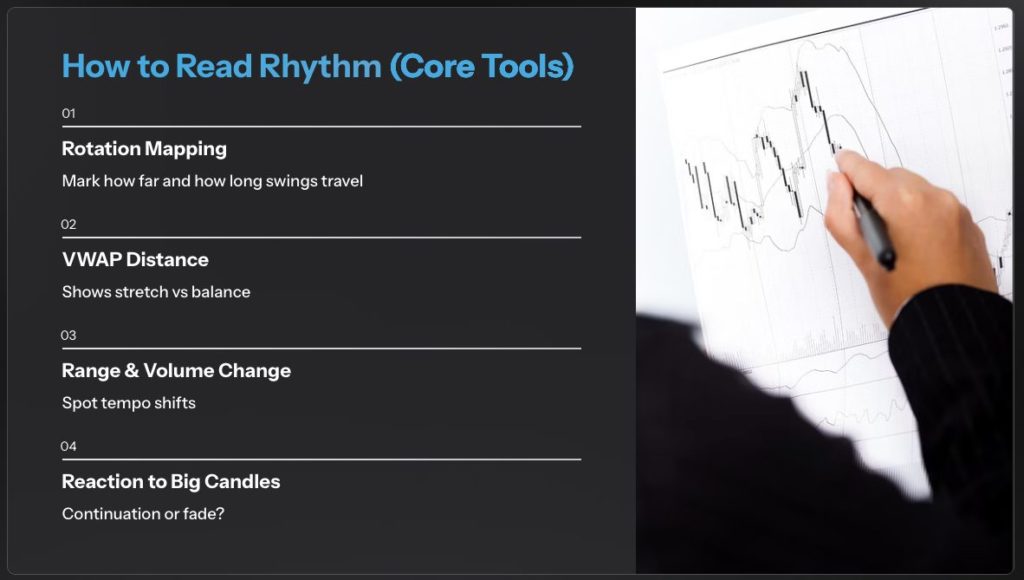

(It’s the core thesis of my Deciphing Market Rhythm webinar…VWAP distance, rotation mapping, all of that.)

So a channel isn’t really a prediction tool.

It’s a simple way to visualise that rhythm.

And when the rhythm changes, you see it instantly.

That’s your channel break.

Now, how you trade that rhythm change is up to you…

But it’s a damn good clue!

So, it turns out maybe channels reveal more than they first appear to…if you know what you’re looking at.