Trading in 2025: Where’s the Edge Now?

Why Trading Is Harder Than Ever, and Where the Real Advantage Still Lies.

Home » Trading in 2025: Where’s the Edge Now?

Some food for thought today whilst this market makes up it’s mind…

Let’s see if the inflation report moves things… oh wait, erm nope.

Even though DJT signed a bill to reopen the federal government, I think the whole data gathering machine stopped completely during the shutdown.

So… we wait ![]()

![]()

Anyway…I’ve got good news and bad news about trading in 2025.

GOOD NEWS & BAD NEWS

![]()

![]()

The barriers to entry have never been lower.

The tech is incredible.

Automation. Easy alerts. One-click orders. (no calling waiting for a dealer to pick up)

Platforms like TradingView. Ridiculously tight spreads.

I mean, back in the day, you’d pay an 8-10 pt spread on an index.![]()

![]()

Now you can trade the DAX with Pepperstone for 0.9 points.

And with a typical daily range of 300pts+ that’s an incredible difference from years gone by.

Execution’s fast.

Charts are stunning and cheap.

Data’s instant.

From that perspective we’ve never had it this good.

![]()

![]()

The game’s more competitive than ever.

The “easy” inefficiencies are gone.

You’re no longer up against a few chart-watchers… you’re up against machines.

Well funded, hyper profitable trading firms, staffed by some of the brightest minds on the planet…

All swimming in the same pool as you. All trying to take yoru lunch…![]()

![]()

The little order-book edge I had spotting rubbish algos in 2005? Long gone..

But…

![]()

![]()

it’s just different…

Now I believe it’s about:

- Selectivity

- Patience

- Sitting on your hands until the perfect setup shows up

You can literally sit in cash all week if you want.

There’s no penalty for waiting.

And most traders don’t realise… that is edge.

While the crowd’s arguing over the next ICT candle…

You’re waiting for the full toss (yes, cricket reference, no sniggering at the back).

The one that fits your plan.

The one that deserves size.

The play with the positive expectancy

So yeah…

The bad news is… the old game’s gone.

The good news?

![]()

![]()

And here’s the really good news:

You can control the variables.

You can’t control spreads or data feeds…

But you can control your actions.

- No excuses.

- No one else to blame.

And yeah, that’s scary for some.

But for people like you and me?

That’s empowering.

Full agency.

Total responsibility.

And the ability to change things when they’re not where you want them to be.

Na…

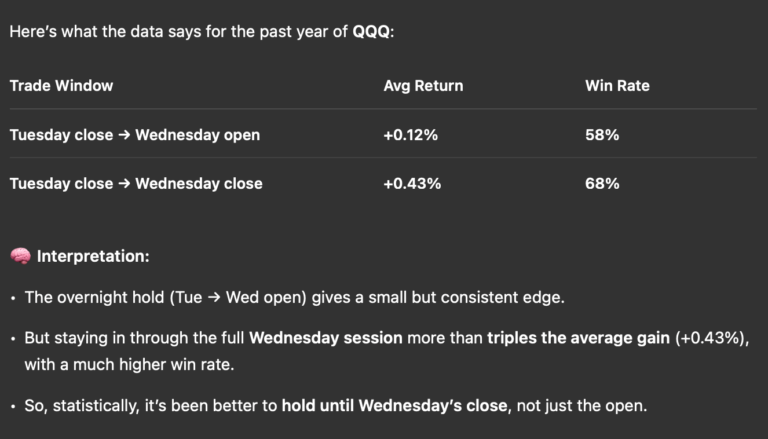

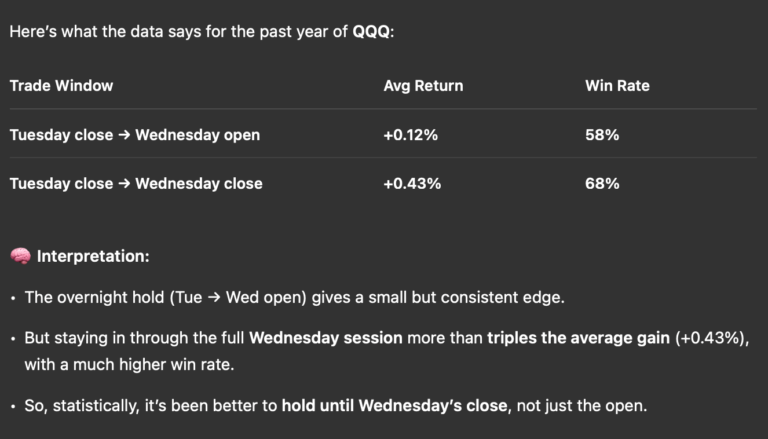

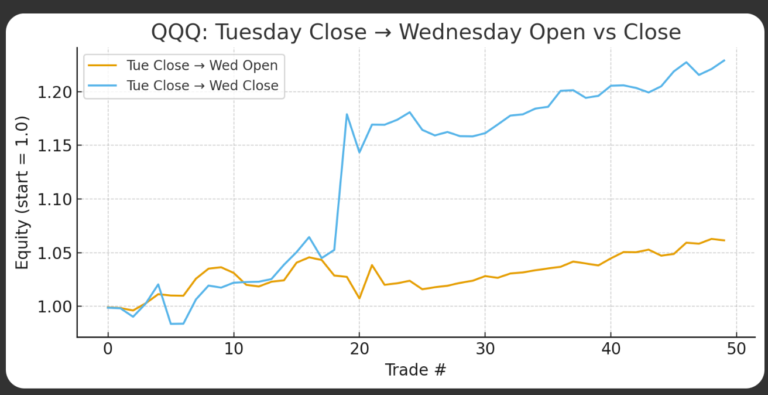

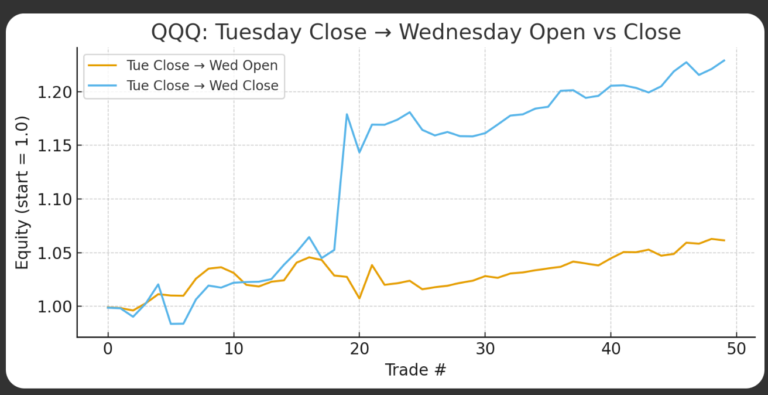

So I switched it:

“How about Tuesday close to Wednesday close?”

That’s better.

Historically (well, a year) buying Tuesday’s close and selling on Wednesday’s close has had a 68% win rate with an average return of 0.43% ($105 on Nasdaq)

So, I asked ChatGPT to plot the equity curve for both.

![]()

![]()

![]()

![]()

Nice smooth slope for the close-to-close version, even if it was skewed by one big day.

Takeaway?

I’m not saying go all-in Tuesday night.

But…

TradingView + ChatGPT = a powerful tool for theme testing.

If you’re curious how I did it step-by-step, watch the Trading Strategy Generation with ChatGPT video here.