Spread Betting With Trading View

The Complete Guide to Using TradingView for UK Spread Betting

If you’re spread betting in the UK, the platform you use makes all the difference.

Clunky, outdated software slows you down. Clean, powerful charts help you spot opportunities and act fast.

That’s why more and more traders are choosing TradingView — modern, intuitive, and packed with the tools serious traders need.

And when you connect TradingView to an FCA-regulated broker, you get the best of both worlds:

For UK traders, it’s a game-changer: finally, a setup that’s simple, regulated, and built for performance.

Home » Spread Betting with Trading View in the UK

Table of Contents

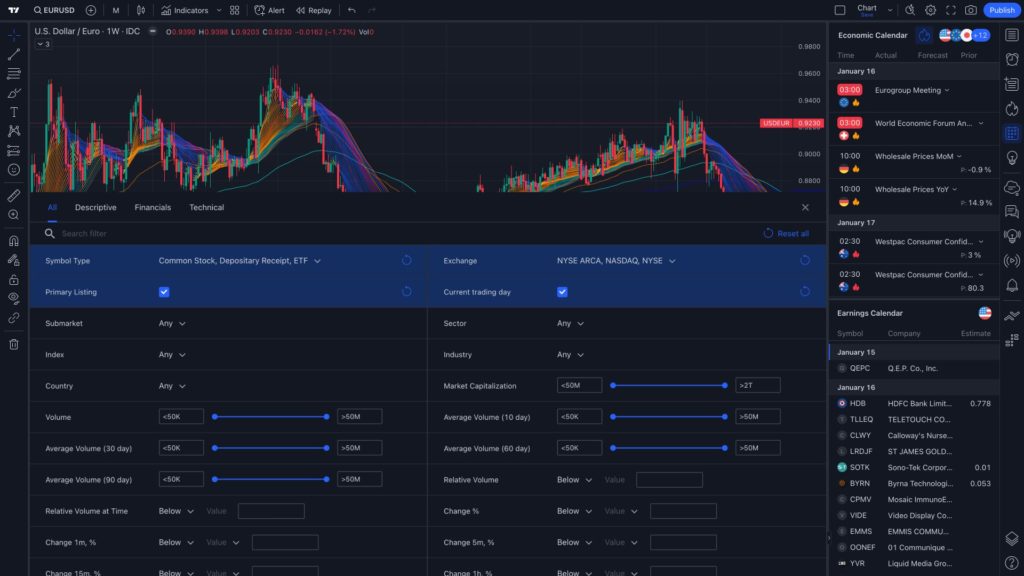

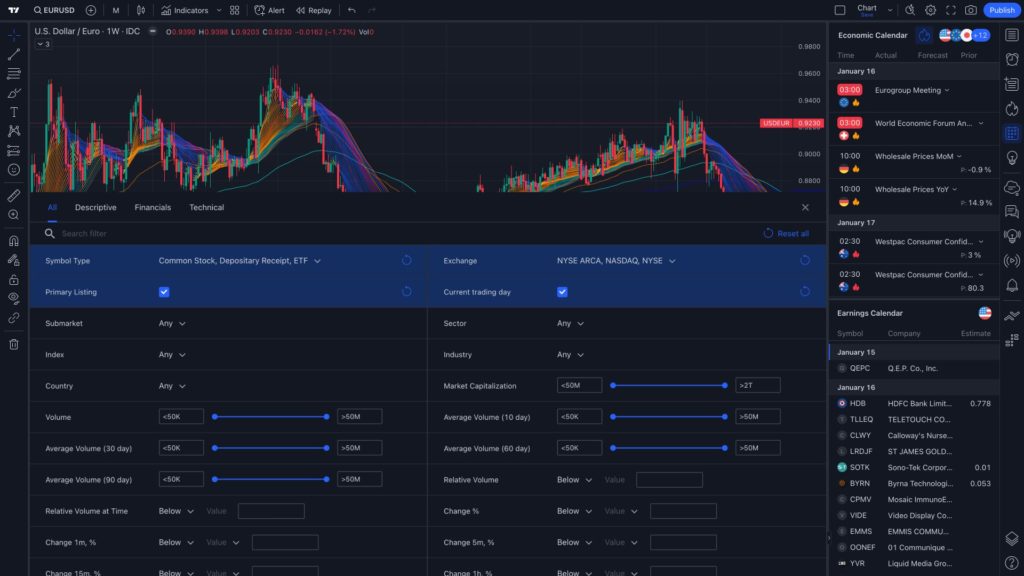

Why TradingView for Spread Betting?

If you’ve ever battled with clunky broker platforms, you’ll know how frustrating it is.

TradingView fixes that.

✅ Clean, modern charts that actually make sense

✅ Replay mode to backtest ideas in minutes

✅ Mobile + desktop access so you’re never tied down

✅ Share charts and setups with a huge trader community

It’s built for traders, not accountants. Everything feels fast, intuitive, and focused on execution.

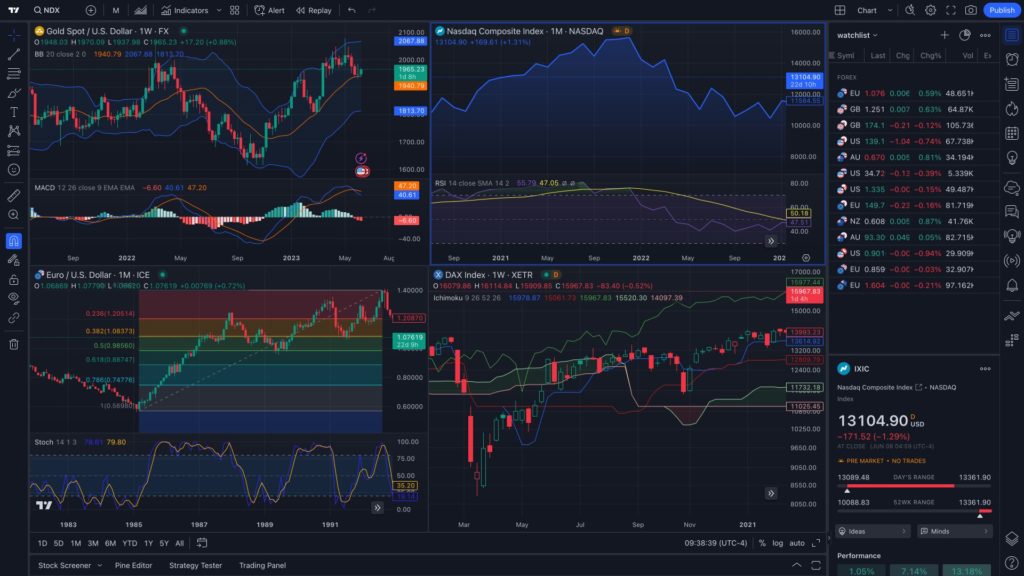

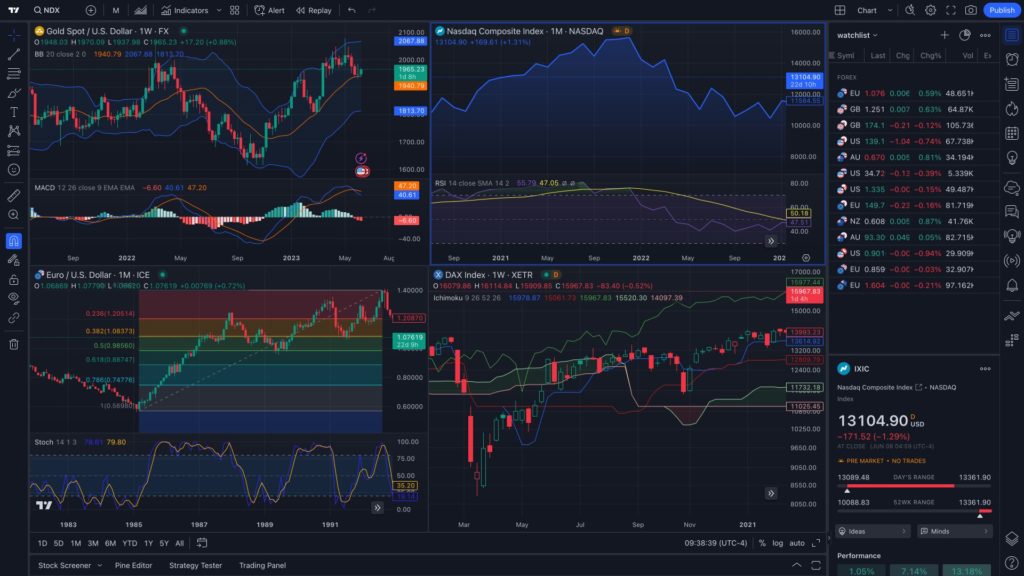

Why Spread Betting + TradingView = A Powerful Combo

Now here’s where it gets good: not every broker integrates directly with TradingView. Pepperstone does

This means you can analyse markets on TradingView and execute trades through an FCA-regulated broker.

Here’s what that gives you:

FAQ: Spread Betting With TradingView

Can you spread bet directly on TradingView?

Yes. TradingView now integrates with certain spread betting brokers, so you can place spread bets straight from your charts.

Is spread betting on TradingView tax-free?

For UK traders, yes. Profits from spread betting are currently free from capital gains tax and stamp duty. (See the full Spread Betting Tax Guide here).

What’s the difference between spread betting and CFDs on TradingView?

They feel similar in execution, but the big difference is tax. Spread betting profits are tax-free in the UK, while CFDs are subject to capital gains tax. (Full breakdown: Spread Betting vs CFDs)

Do I need a separate account for spread betting?

Yes. You’ll need to open a spread betting account with a broker that supports TradingView integration.

Is TradingView better than a broker’s own platform?

For many traders, yes. TradingView offers cleaner charts, more tools, and a big trader community. When linked to a top-tier FCA-regulated broker, you get both great analysis and smooth execution.

Is spread betting risky?

Yes. Spread betting uses leverage, which can magnify both profits and losses. Always start small, use stop-losses, and practice on a demo before risking real money.

✅ Ready to Try Spread Betting on TradingView?

You’ve seen why TradingView is the go-to charting platform, and why pairing it with Pepperstone makes spread betting seamless, regulated, and tax-efficient.

Now it’s your turn to put it into action:

1. Open a Pepperstone spread betting account

2. Connect it to TradingView

3. Start trading directly from your charts