Learn to Trade

Strategies, psychology, and tools every trader should know.

Home » Learn to Trade

Learning to trade? Yeah, it can feel like staring at hieroglyphics at first.

“What the hell does that mean?”

“Why did it just move like that?”

Relax… we’ve all been there.

The trick is not to drown yourself in noise.

You just need a few solid building blocks: a handle on risk, a simple strategy, a bit of psychology, and the right tools. That’s it.

So if you’re starting fresh, or you’ve had a crack at trading but still feel like you’re guessing, stick around… I’ll point you to the good stuff.

And if you want regular ideas without the BS, grab my daily trading email… simple ideas that actually help you trade better.

Table of Contents

Understand Risk

Most traders don’t get wiped out because they pick the wrong direction; they blow up because they ignore risk.

Oversized trades, sloppy stops, holding when they should bail. Get this right and you’ll stay in the game long enough to actually learn the rest.

- Sizing trades properly

- Knowing when and where to place a stop

- Avoiding the classic "all-in" new trader mistake

Learn optimal risk management strategies, how to set stop loss levels in day trading, a video on advanced stop loss tactics and why martingale is a bad idea!

Build a Simple Trading Strategy

Most traders jump from one setup to the next like they’re speed-dating indicators.

That’s why they never get anywhere.

You don’t need twenty strategies to start with… You need one that’s simple, repeatable, and makes sense to you.

Learn it inside out, stick with it through good days and bad, and that’s when things start to click.

- Spotting when markets are trending vs ranging

- Using time of day and volatility to your advantage

- Exploring simple, mechanical setups like opening range breakouts

👉 Explore our Trading Strategies page for simple, practical setups to test and refine. Or dive into 10 Trend Trading Strategies, 10 Mean Reversion Strategies and Rule Based Day Trading Strategies.

Trading Psychology and Discipline

The market doesn’t just test your account… it tests your head.

Fear, greed, hesitation, tilt, boredom trades… every trader wrestles with them. The ones who win aren’t immune, they’ve just built habits and routines that stop emotions running the show.

- Controlling tilt and revenge trading

- Building habits that keep you consistent

- Simple drills to sharpen discipline

👉 Start with our Trading Psychology hub, or go straight into the Psychology of Holding Winning Trades, insights for optimising trading decisions or listen to my Visualisation for Traders podcast episode.

Tools of the Trade

You wouldn’t show up to a boxing match without gloves…same goes for trading.

You don’t need fancy kit, but you do need the basics: a decent charting platform, a journal that keeps you honest, and a plan you can actually follow. The right tools won’t guarantee profits, but without them you’re basically winging it.

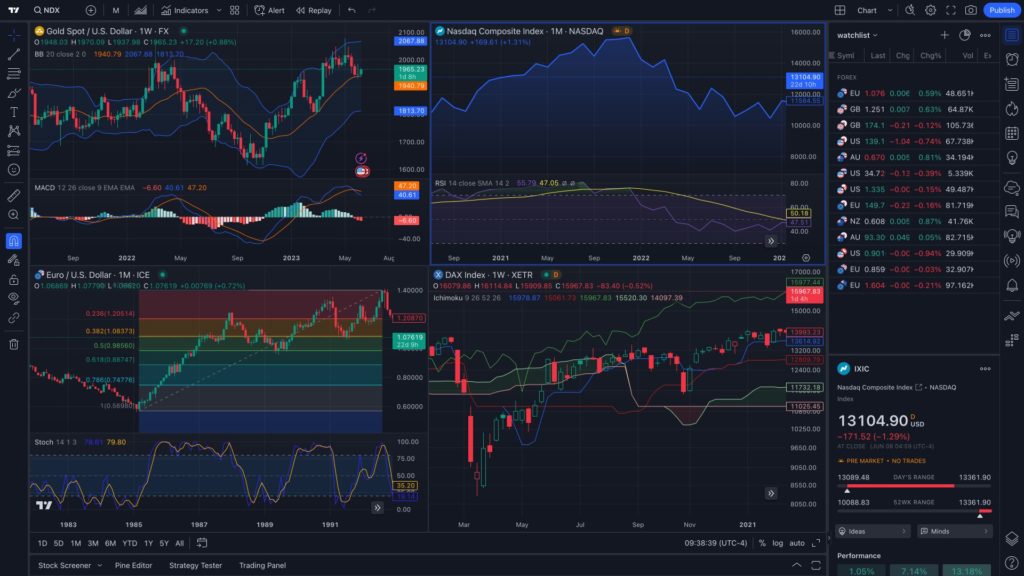

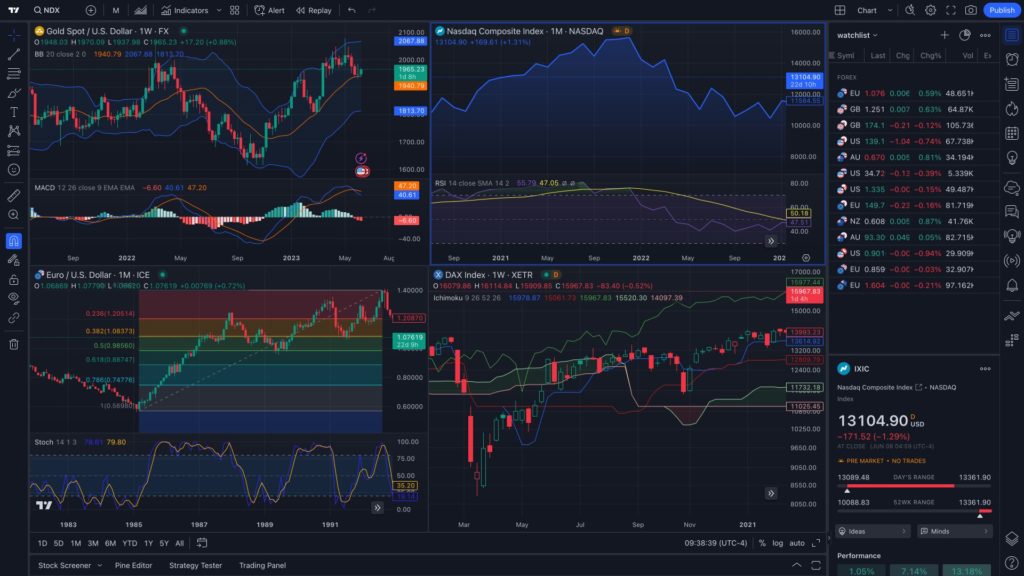

- A reliable charting platform (TradingView)

- A trading journal to learn from every trade

- A plan that keeps you accountable

👉 Check out the Trading Journal I recommend, how to construct a trading plan that works for you, and Spread Betting with TradingView in the UK.

For charting, TradingView beats most platforms.

Trader Journeys

No one figures this game out in a straight line. Every trader takes a few hits, tweaks their approach, and keeps swinging.

The best way to learn is to see how others did it, their scars, their breakthroughs, and the lessons they wish they’d known earlier.

- Stories of traders who battled through setbacks

- Real examples of consistency finally clicking

- Lessons from both full-time and part-time traders

👉 Hear more journeys in my Trader Podcast Series — lessons from pit traders to blown accounts to breakthrough moments.

And if you want a classic read, check out Don Miller’s Trading Journal, he documented his journey making millions trading the S&P 500. It’s old-school but full of lessons.

Worth A Look

More lessons, ideas, and rabbit holes for traders who want to dig deeper

Psychology, Mindset and Habits

Beginner or intermediate, you’ll find focused next steps over on the Traders Mastermind homepage, curated trading content for serious traders.

Good trading,