ChatGPT Overnight Trading Strategy

How I Used ChatGPT to Test a Simple Overnight Trading Strategy.

Home » ChatGPT Overnight Trading Strategy

I want to show you something today…

How I used ChatGPT to quickly model out a simple overnight trading strategy.

After another weekend gap up on Monday.

I was curious:

“Which days are best for an overnight gap up?”

I’m talking NYSE close to NYSE open

Simple structure: buy at the close, sell at the open.

ENTER CHATGPT

So I enrolled my analyst and backtesting expert Monsieur Chat GPT…

Now, before you quant inclined traders whinge and moan and tell me “hmmmph that’s not a proper backtest”

Relax, I’m not building a production algo here…

I simply wanted to know if there has been an edge in holding overnight, and if so, was there a specific day which stood out as the best?

So, I uploaded a year of QQQ (Nasdaq ETF) daily data to ChatGPT.

(Close and next-day open = easy gap calc).

First, I checked weekend holds.

Decent…

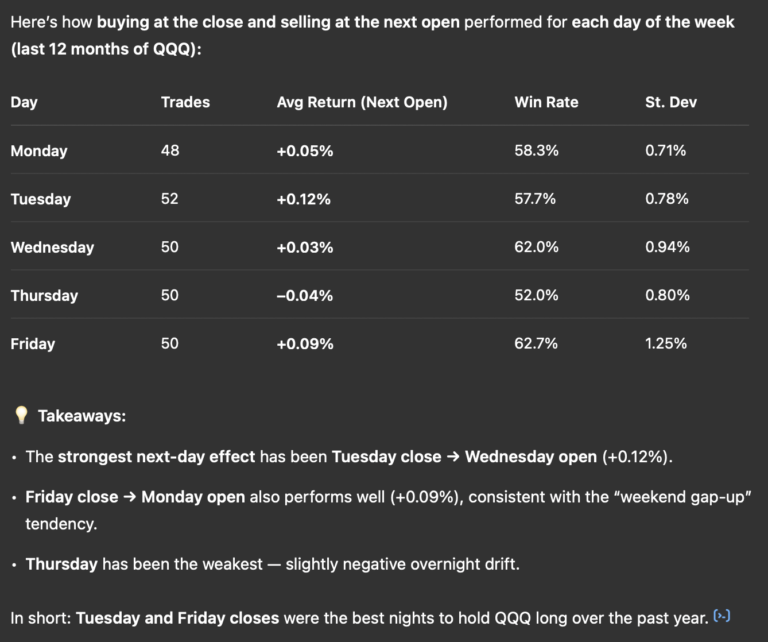

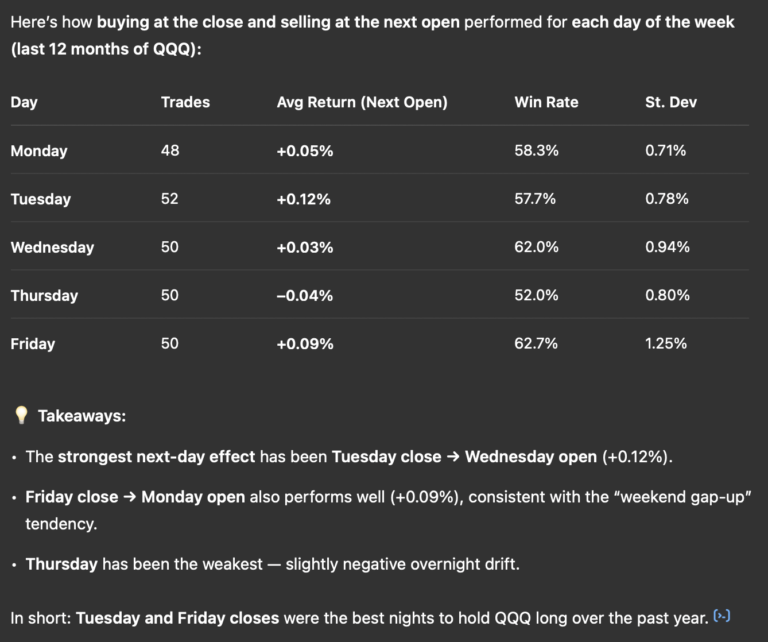

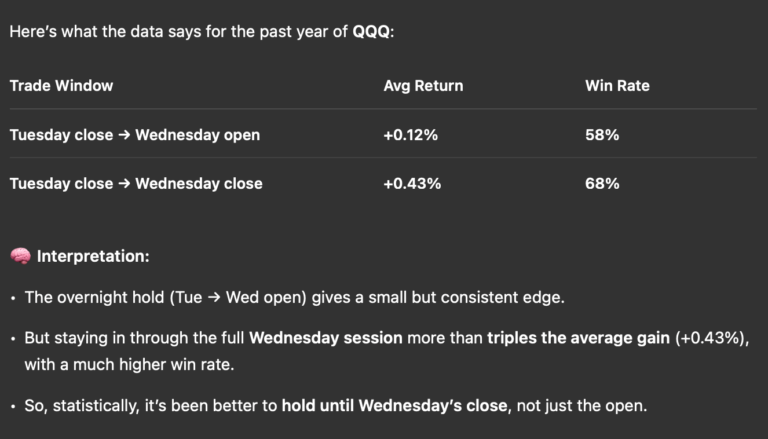

But, then I thought… “Let’s test by weekday.”

(image above)

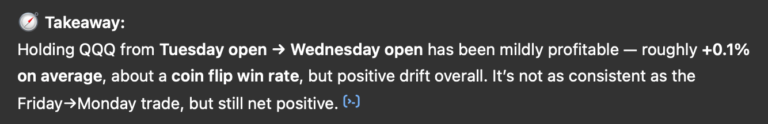

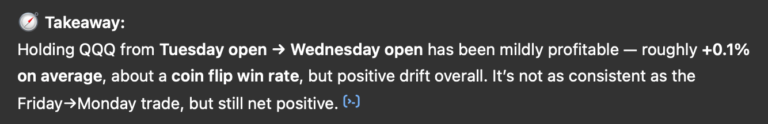

This was a good start, Tuesday close to Wednesday open worked (ish)…

![]()

![]()

![]()

![]()

![]()

![]()

(For context, 0.12% is about $30 on the Nasdaq or 60pts on the DOW)

Ok, let’s take it one step further…

“What about buying Tuesday OPEN selling Wednesday OPEN”

Na…

So I switched it:

“How about Tuesday close to Wednesday close?”

That’s better.

Historically (well, a year) buying Tuesday’s close and selling on Wednesday’s close has had a 68% win rate with an average return of 0.43% ($105 on Nasdaq)

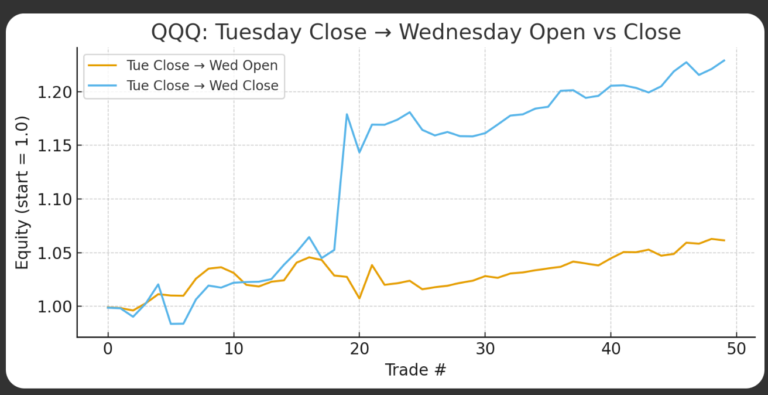

So, I asked ChatGPT to plot the equity curve for both.

![]()

![]()

![]()

![]()

Nice smooth slope for the close-to-close version, even if it was skewed by one big day.

Takeaway?

I’m not saying go all-in Tuesday night.

But…

TradingView + ChatGPT = a powerful tool for theme testing.

If you’re curious how I did it step-by-step, watch the Trading Strategy Generation with ChatGPT video here.