Gold Spread Betting Guide UK (2026 Edition)

How to Spread Bet on Gold (From a Trader’s Perspective)

Home » Gold Spread Betting Guide (UK 2026 Edition)

So you want to explore spread betting on gold…

Well, you’re in the right place

This guide is for UK traders who want to understand how to spread bet on gold.

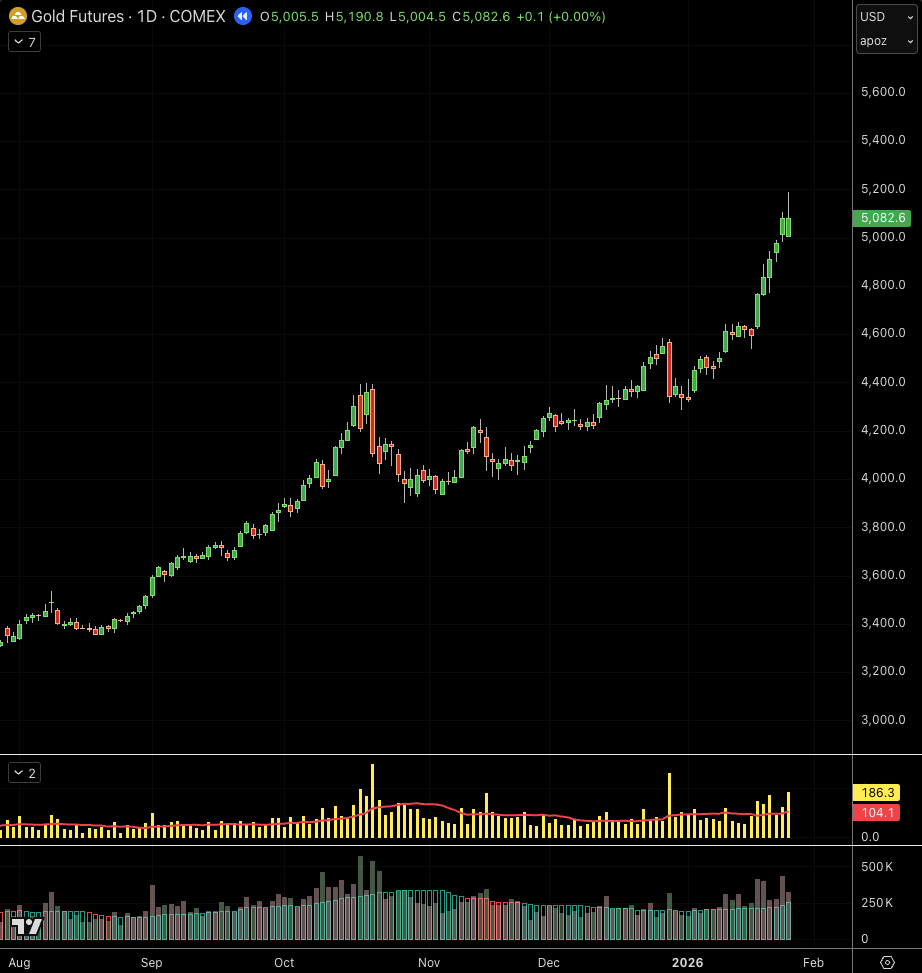

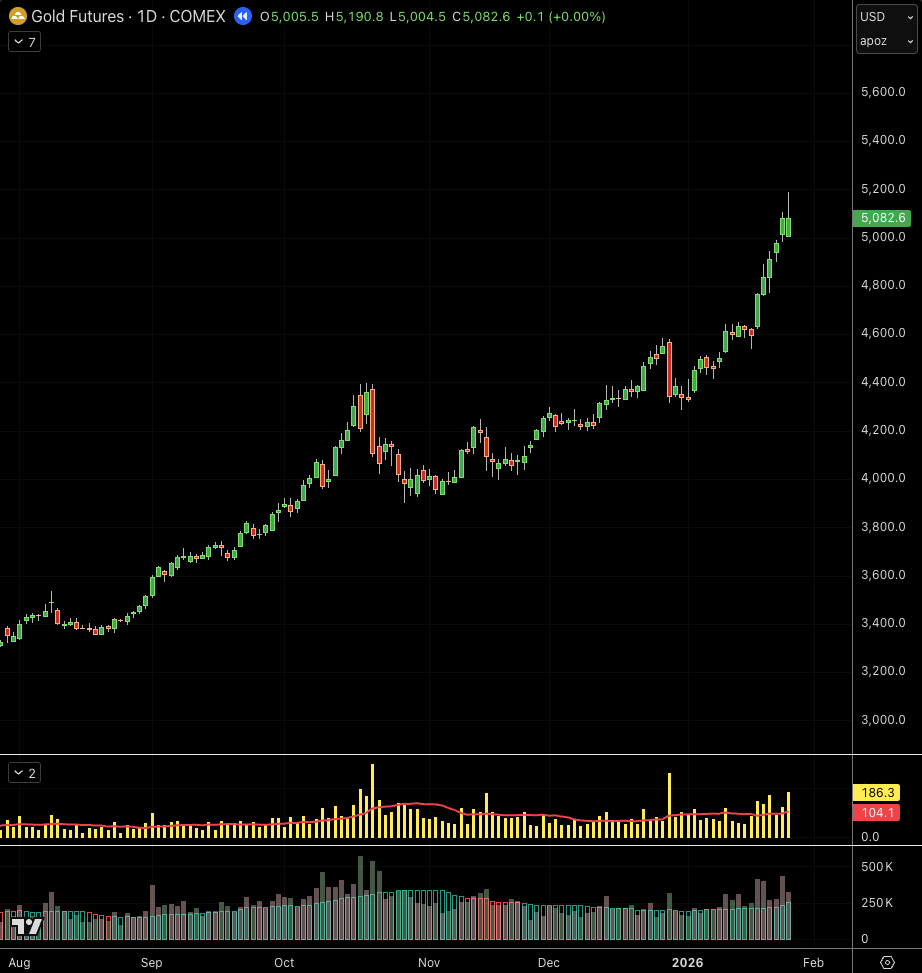

Yes, gold and the metals are super active right now (this is the most volatile I’ve seen it in my 25-year trading career…)

But if you want to trade the price action, it makes sense to learn how gold moves, why gold moves, and get as much knowledge as possible before placing real trades, right?

I’m going to cover everything from:

Gold spread betting is one of the most popular markets for UK traders, and for good reason: the yellow metal is highly volatile, super liquid and offers some pretty unique tax benefits for UK residents.

So, whether you’re looking for day trading opportunities, swing trades, or simply want to diversify your trading playbook, understanding how to spread bet on gold can give you an edge.

I’ll walk you through everything you need to know: spreads, charts, risk management, strategies, and the crucial tax angle.

All in plain English, from someone who’s actually traded these markets for a few decades…

Let’s get into it,

Mark

Gold Spread Betting for UK Traders - Key Points

Before diving into the details, here’s a quick summary of what UK traders need to know about gold.

Quick Answer: What Gold Spread Betting Actually Is

Spread betting allows you to speculate on whether the price of gold will rise or fall without owning the actual asset.

So, if you have a view over a few days or even a few minutes (some wild traders even trade over seconds!)

You can express that with a spread bet…

- Speculate on Gold Price Movements Without Owning Gold: Spread betting allows you to speculate on whether the price of gold will rise or fall without owning the actual asset. No need to store and insure your bullion.

- Tax Advantages: In the UK, spread betting profits are currently exempt from Capital Gains Tax and Stamp Duty. Nice perk for British traders.

- The Spread Is the Cost of Trading: The spread in spread betting is the difference between the buy and sell price quoted by the broker, which represents the cost of placing a trade. A tighter spread equals a lower initial trade cost.

- Leverage Amplifies Gains and Losses: The potential for profit or loss in gold spread betting is amplified by the use of leverage, which can magnify both gains and losses. It’s a double-edged sword…

- Overnight Financing Charges: Positions held overnight in gold spread betting may incur financing charges or rollover fees. No relevance if you are a gold day trader, but worth considering if you hold positions for days or weeks.

- Regulated and Legal in the UK: Spread betting is regulated by the Financial Conduct Authority (FCA) and is fully legal in the UK. Nothing dodgy about it, contrary to what the bloke down the pub tells you…

- Profit/Loss Calculation: Your profit or loss in spread betting is calculated based on the number of points the market moves multiplied by the stake per point. Simple maths…

More on all this stuff later.

Want to follow along with real prices?

If you want to see how gold spread betting works in practice without risking any money, opening a free demo account is the best place to start.

Brokers like Pepperstone let you practise with virtual funds, live gold prices, full charts, and no pressure to trade real money.

And remember this… gold spread betting is a way to speculate on gold prices without ever touching the stuff.

What is Gold Financial Spread Betting?

We’re talking about UK financial spread betting here. As opposed to CFDs, which don’t have a tax benefit… check out my spread betting vs CFD guide.

You’re betting pounds per point on whether the gold price (quoted in US dollars per troy ounce) moves up or down.

And boy, can this market move…

The moves are usually measured in $0.10 increments (a tick) on the COMEX futures exchange.

But it works slightly differently for a spread bet.

If gold moves from $5,240.0 to $5,245.0, that’s considered 5 points.

And your profit or loss equals points moved multiplied by your stake.

So if you’re long £100pp and you get a 5 point move in your favour, that’s five hundred quid in your pocket…

Simple maths. But here’s where it gets serious…

This is leveraged trading ladies and gents. You’re controlling a large position with a relatively small deposit. And that means you can lose money faster than you expect if you oversize.

Much faster. So take it steady…

Still here after that?

Good!

Ok, so the rest of this article will walk through spreads, live examples, charts, and risk management.

All in a calm way. No BS. Just the stuff that actually matters when you’re trading gold.

Table of Contents

How Gold Spreads Work (and Why They Matter)

Before you open any broker account to trade gold, look at two things first: the spread and the minimum stake size.

The spread in spread betting is the difference between the buy and sell price quoted by the broker, which represents the cost of placing a trade.

For gold, you might see something like 4174.30 / 4174.50 That 0.2 point gap? That’s your cost to enter and exit.

Gold Market Context & Live Pricing Data

So you def need a broker with a tight spread even during fast markets, otherwise you are just throwing money away for no reason!

(As a trader, you want to be playing in active market conditions; the last thing you need is the broker working against you. Choose a good one.)

Tight spreads matter more if you’re scalping. You’re in and out quickly, so every fraction of a point counts against you.

Let me give you an example.

So you want tight spreads.

Gold is quoted in US dollars per troy ounce on global markets.

Spread betting platforms mirror that pricing but convert your P&L into GBP automatically, so you’re not messing about trying to convert your P&L from dollars back to sterling.

Oh, and it’s worth mentioning…the price doesn’t exist in a random vacuum.

When volatility spikes, say, after an FOMC announcement or a Trump tweet shock, the spreads can widen whilst the trading algos battle it out with each other…

And when volatility increases, so does the typical range.

TIP: Active traders want big intraday ranges vs the spread.

Back when I started trading in 2001, the spreads were obscene compared to the daily range. Tough to fight.

There’s never been a better time to become a trader…

Ways To Trade Gold. (CFD Trading, Gold Futures, Spread Betting)

In the UK, you’ve got a few different ways to actually trade gold:

Gold Spread Betting

Spread bet using a spread betting broker.

CFD Trading

Trade via a CFD (some multi-asset brokers offer both CFD trading and spread betting)

Gold Futures

Gold ETF

Trade a gold ETF (Exchange Traded Fund) like GLD.

Assuming you decide to spread bet… here are some of the things to look for in a gold spread betting provider.

Tight and consistent spreads on XAU/USD – not just during quiet hours, but through volatile markets too

Clear margin requirements – You want to know exactly what deposit is needed per trade

Decent execution around big data releases – No re-quotes or mysterious slippage

No minimum deposit – If you decide to trade live, you want to start small

FCA Regulated – Stick with a regulated firm so your funds are safe

Oh, and make sure the markets are explicitly labelled as “spread bet” rather than CFD if you want the capital gains tax treatment.

Getting Spread Betting Prices and Charts for Gold

Traders live on the chart.

Price is the only thing that pays, so we need decent feeds and tools… (like a mechanic!)

Most spread betting platforms present gold markets like this:

Gold Rolling Daily: 4345.8 / 4346.3

Stake: £1 per 1 point

On a normal, steady day, gold might swing 100-200 points.

That’s £100–£200 of P&L movement on a £1 stake. Scale that up to £5 , £10 or even £100 per point, and you see why position sizing matters…

What you want from charts:

Multiple timeframes (5m, 1h, 4h, daily)

Drawing tools for support and resistance

Volume and volatility indicators

Ability to place orders straight from the chart

Custom layouts and colours (cos why not?!)

Gold trades nearly 24 hours on weekdays.

Ideally, your charts should show clear session separations. Asia, London, New York, so you can see when liquidity actually kicks in.

Most platforms do this, but some old school stuff might not…

(I use Trading View charts, which do this nicely)

Top-Level Charts and Tools for Gold

Don’t believe what the gurus say… You don’t need fancy tools or indicators to trade gold.

Your opinion on direction and risk management is most important.

But bad tools can definitely hurt…

Here’s an example of simple tools and indicators some traders like to use when trading Gold:

Moving averages (50-day and 200-day) for trend context and crossover.

ATR (Average True Range) for setting realistic stop distances and assessing volatility.

Basic support/resistance levels drawn manually with your drawing tool.

Something like Stochastics or Bollinger Bands as an overlay, but remember, traders… price is king

Decent trading platforms should let you save layouts, backtest simple ideas, and replay sessions to see how gold moved during key events like Fed meetings, CPI releases or just wide range trading days.

Tick charts are nice for very short-term trading. But most people survive fine with decent time-based candlestick charts and fast execution.

Don’t overcomplicate it when starting out 🙂

Where Can I Practice Trading Gold for Free?

I honestly think every trader should play around on a demo first.

Not in a live account where it actually hurts… You can trade live when you are ready.

A gold spread betting demo account typically offers:

Paper balance (usually £10,000 virtual funds)

Live prices

The same gold markets as the real platform

A chance to play around risk free

But it’s worth remembering… a demo is for learning mechanics, not for proving a strategy “works.”

Emotions are very different when you’re risking real money.

Trading psychology is real!

Using a Free Gold Demo Account Properly

Most people abuse demos. They go all-in with crazy stakes and call that “testing.” Don’t do that…please.

Here’s how to actually use a demo:

Trade with realistic stake sizes – if you’d use £1 per point live, use £1 per point in demo

Use the same timeframes you plan to trade live

Practice specific tasks: placing limit orders, moving stops, handling overnight positions

See how weekend gaps affect P&L – gold can gap on Sunday opens

I’d suggest tracking at least 30–50 demo trades on gold before going live.

Not to prove you can win, but to understand volatility and market movements.

Demo won’t simulate real fear and greed. But it will expose basic mistakes like entering the wrong direction or misreading point values.

Way better to make those errors with fake money.

You can try Pepperstone’s free demo as a starter.

Now, the UK tax point.

As of 2026, spread betting profits in the UK are exempt from capital gains tax and stamp duty. That’s a genuine advantage over traditional trading or CFD accounts.

But, a small caveat….losses on spread bets can’t be offset against other taxable profits. Unlike share trading, you can’t write off a bad gold trade against your other gains. That “tax-free” label cuts both ways.

Not relevant for most active traders, but worth being aware of.

And one more thing: “commission-free” doesn’t mean free trading. Your costs are baked into the spread and overnight financing. Nothing is ever truly free in financial markets…

How To Place a Gold Long Trade via a Spread Bet

Most brokers offer a “Gold Rolling Daily” which, unlike a futures contract, has no fixed expiry.

This sounds more complicated than it needs to be, but honestly, it’s just an easy way to speculate on the price of gold without worrying about futures contract dates or getting a load of gold delivered on your drive if you hold to expiry, like you possibly could if you trade the futures markets. (imagine!)

Stakes usually work like this: £X per $1 move.

So if you’re trading £20 per point and gold moves $5, that’s 5 points. Your P&L moves by £100.

Before I enter any gold trade, I always know these numbers:

Entry level

Stop level

Stake per point

Total £ risk for the trade

(Always size backwards from my maximum £ risk. Not forward from how much you “want” to make.)

Here’s a quick example:

Gold moves from 5101.44 to 5151.44

That’s 50 points (50 dollars)

At £10 per point your profit = 50 × £10 = £500

If it went the other way, down 50 points, you’d lose £500. Same maths, opposite outcome.

Note, in the above example, some brokers use $0.01 as a ‘point’.

So you’d be up 500 points if they worked like that.

You’d simply adjust your position size to suit… that’s why a demo is important. Just play around with the platform and virtual funds first.

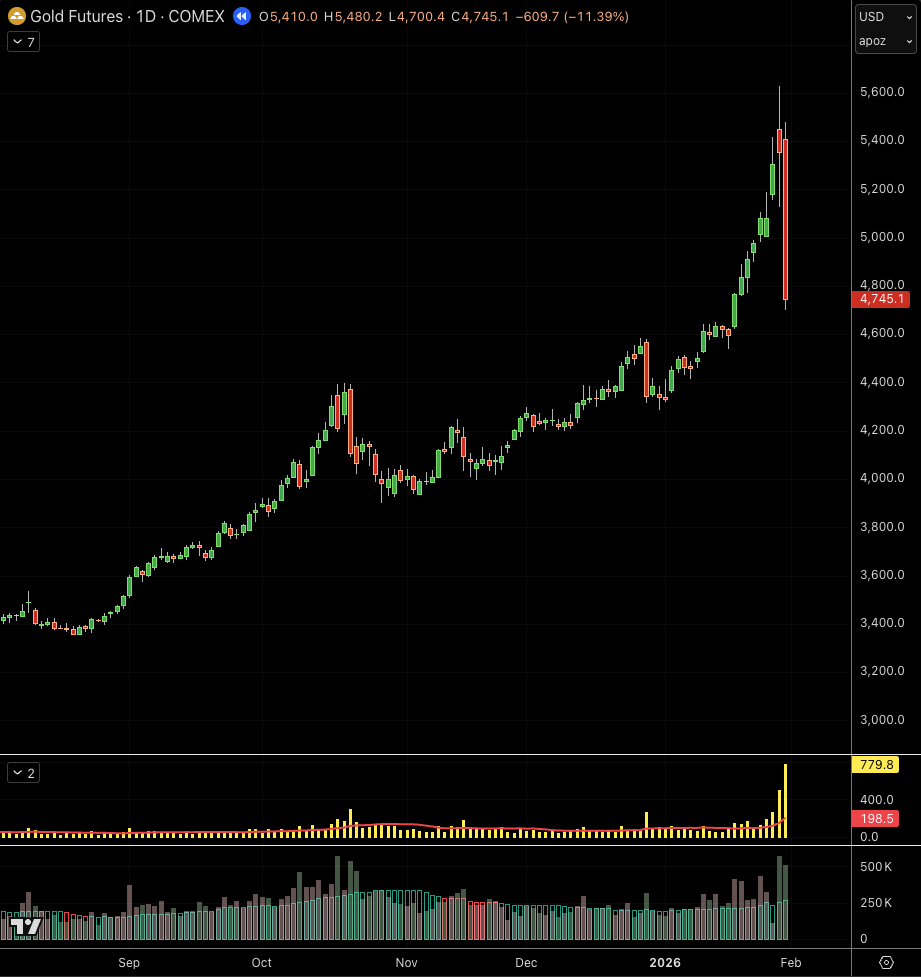

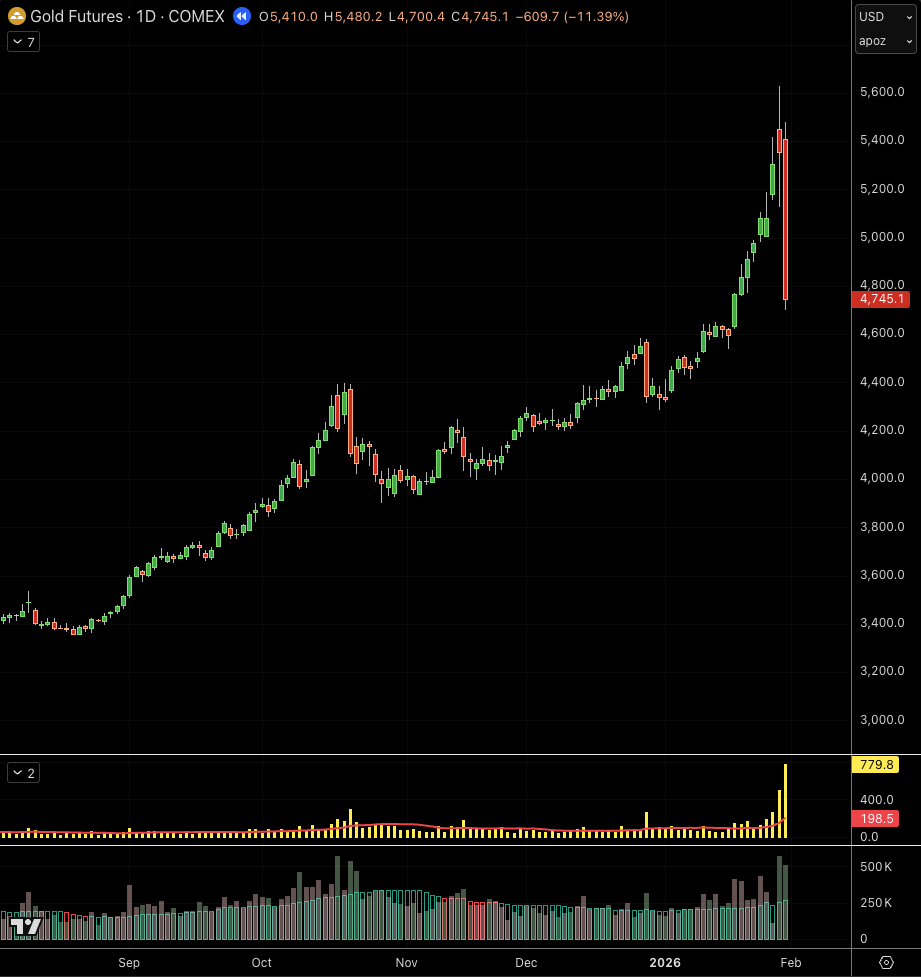

Short Gold Spread Betting Example

One of the advantages of spread betting is that you can profit from a down move as well as an up move in the gold price.

So if you think gold is overvalued, you can place a short trade, meaning you’d profit on that position if gold moved lower.

Let’s have a look at a hypothetical example.

Imagine you saw the run up on Gold, you heard your taxi driver telling you how he’s buying Gold, saw your Uncle checking the Gold market, and so thought to yourself…

“Hang on, this feels overdone. I like to be a contrarian. I fancy a gold short trade”

Well, if you timed it right and the gold market drops… You did very well.

But, get it wrong, and you could lose money rapidly. (which is why managing risk with a stop loss is essential)

Or as old school traders say when you’re short, and the market keeps going up…

“Getting your face ripped off”

What a pleasant bunch we are!!

Commitment of Traders (COT) and Gold

The COT report is a weekly snapshot from the CFTC showing who holds which positions in gold futures. It comes out every Friday, covering positions from the previous Tuesday.

So by the time we see it… the market has moved on a bit.

The report breaks down positions into three main groups:

Large speculators (hedge funds, managed money)

Commercial hedgers (producers, refiners)

Small traders (retail)

Some traders like to watch the big specs versus commercials in gold. When these groups are extremely positioned one way, it tells you something about sentiment.

But COT is a background tool for sentiment, not a timing trigger. Real trades should still be driven off live price action and risk limits.

Former Market Wizard Jason Shapiro is well into trader positioning… so he is a far better trader to listen to about COT than I….

How The Gold Market Works

Gold matters. It’s been around for decades as a store of value, and it has a habit of waking up when everything else is on fire.

But gold is different from oil or wheat. It’s not really consumed. It’s mostly held, recycled, and repriced. The physical gold above ground keeps growing, but it rarely disappears.

Main Drivers of Gold Prices

The main drivers of gold prices include:

Real interest rates (especially in the US)

US dollar strength (the dollar falls, gold often rises)

Central bank buying (particularly from emerging markets)

Risk sentiment (fear vs greed)

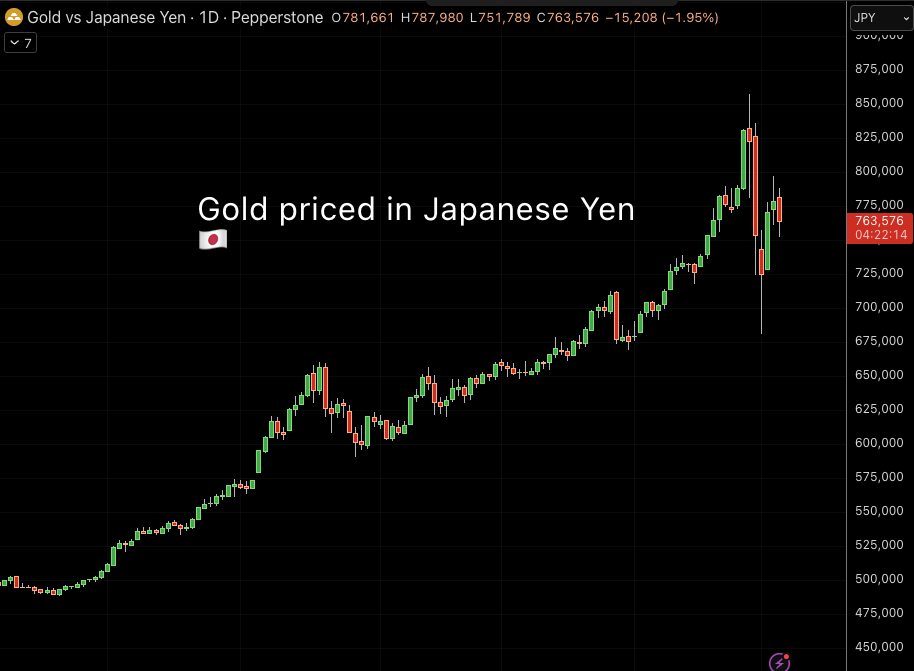

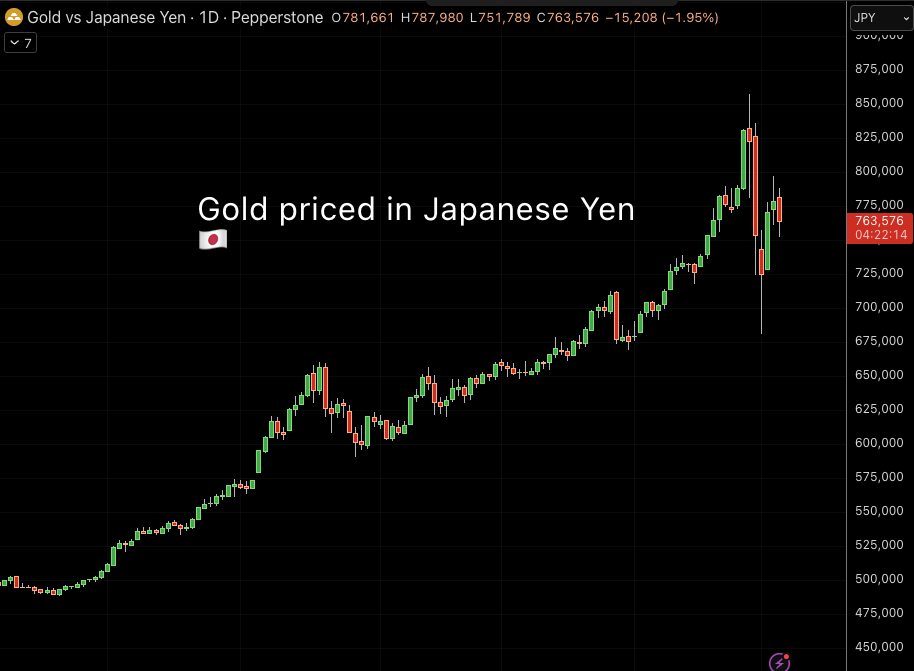

Some historical context: gold ran from around $300 in the early 2000s to over $1,900 in 2011. Then it pushed above $2,000 during COVID and inflation scares, before trading above $5,500 in 2026.

Major metals don’t move like that without fundamental shifts.

As a spread bettor, I’m not taking delivery. I’m just riding the price waves driven by this bigger macro ocean.

China, India, and Physical Gold Demand

China and India have been major consumers for years. Together they often account for a large chunk of annual physical demand.

While we’re clicking buttons on screens, a lot of gold demand is still jewellery and investment demand from Asia.

Specific periods when demand picks up:

Chinese New Year

Diwali season

Wedding seasons across South Asia

For a spread bettor, this is background flow.It won’t help time your intraday trades.

But it explains why gold can hold strong even when Western sentiment looks shaky.

And as in all trading, having a key understanding of the market drivers is key…

Gold as a Hedge

People love to call gold a safe haven hedge. But in a leveraged spread bet, it’s still a trade with margin calls.

Traditional hedge ideas make sense: central banks hold gold reserves as a backstop, investors buy gold when they distrust fiat currencies or equities.

But here’s the reality…

If I “hedge” my equity portfolio with a gold spread bet, I’ve still added leveraged risk.

If gold drops while stocks drop, I’m worse off. Not hedged. Just exposed in two directions. This is one of the many pitfalls traders face, and it’s crucial to stick to a strategy long enough to see results.

Treat gold spread bets as speculation with a defensive flavour. Not as some sort of magic shield against all macro trouble.

How Gold is Priced in the Forex Market

Every gold chart a UK spread bettor looks at is really a blend of gold and the US dollar. Otherwise known as XAU/USD or Gold priced in dollars.

You can trade gold priced in Euros or British Pounds (or most major currencies, for that matter)

Most gold is priced in USD.

So a weaker dollar tends to support higher gold prices. A stronger dollar often pressures gold lower.(That’s a rule of thumb, but not always true)

Simple example: if DXY rips higher on a hawkish Fed surprise, gold often sells off hard in spread betting platforms. The forex markets and gold are linked.

UK traders often see prices and P&L in GBP, but the underlying move is still gold versus USD. Moves in the currency pair GBP/USD can slightly blur the picture… if sterling weakens, your GBP profits might look different from the raw USD move.

We’re getting into foreign exchange technical details here; in reality, having your account in sterling is one of the things that makes a spread betting account attractive.

Big forex events belong on any gold trader’s calendar:

US CPI

FOMC meetings

NFP releases

Spreads widen and slippage grows around those releases. That’s when market gaps can hurt you.

Pay attention to both the gold chart and a basic USD index or EUR/USD chart. It helps you understand if a move is “gold-driven” or “dollar-driven.”

Applying Fundamental and Technical Analysis to Gold Spread Betting

Gold doesn’t care about our opinion. It reacts to flows, data, and fear.

I usually blend fundamentals with technicals to avoid trading blind:

Fundamentals set the backdrop. The directional pressure, if you like. Why gold might want to trend up or down for months

Technicals decide where I actually pull the trigger on the trade.

Fundamental Drivers

Gold’s big swings usually start with some sort of macro theme.

Key fundamentals to watch: (not going to go too deep here, just a taster)

Real interest rates (especially US real yields)

Inflation expectations

Central bank policy (Fed, ECB decisions)

Major geopolitical tensions

Systemic risk (banking stress, credit events)

Technical Tools

This is the nuts and bolts of where most retail traders sit… using charts to time market direction.

Core concepts to focus on:

Trend direction on daily and 4h charts

Obvious support/resistance levels (the stuff everyone can see)

Volatility (ATR) for stop and target distances

Keep it simple:

Trend lines

Horizontal levels

Maybe one trend indicator (Moving averages work fine)

Example Gold Trading Strategy: Asian Session Breakout

Here’s a quick gold setup idea, very similar to the opening range breakout strategy on indices:

If gold breaks above or below the Asian session range and holds, this opens up a potential bigger move through London and US sessions… see a gold spread bet example below:

Gold settlement is at 18:30GMT.

It trades 24/5 pretty much, but a lot of the futures contracts and options on the underlying market get settled at this time. So you might want to square off any positions at that time (but don’t have to)

Don’t overfit. Ichimoku, Fibonacci extensions, and dozens of indicators just create noise.

The simpler your trading strategy, the easier it is to execute under pressure and avoid overthinking.

It’s easy to lose money when trading spread bets if you overcomplicate things…

How to Approach Gold Spread Betting in Practice

I hope this guide has been helpful to you. Remember, gold spread betting is volatile, leveraged, and high risk.

But it’s also very tradable market with a simple, disciplined approach.

Good trading,

Mark

Frequently Asked Questions

What is a good spread for gold?

Gold spreads vary by session and volatility. But under normal market conditions, you should expect a spread of around 0.3-0.8pts.

So, for example, the gold quote as I’m typing this is 4859.61 -4 859.96. Which is a 0.35pt spread.

Another broker has it at 4859.53 – 4860.28, which is a 0.75pt spread.

Why can the gold spread widen at certain times?

Asking why the gold spread widens at certain times shows you are observant!

Spreads often widen before or during news releases. Like FOMC, Non Farm Payrolls or CPI.

The gold spread can also often widen overnight when there’s less liquidity and fewer participants around.

When is the gold spread usually tightest?

The gold spread is usually tightest during the London and New York sessions. Roughly 08:00 – 21:00 GMT

For the tightest spreads and best liquidity, the overlap between London and New York, around 14:30–18:30 GMT, is often ideal.

Why is gold spread so high?

The gold spread is not very high when you consider the average daily range.

Spread vs movement potential is what matters for active trader and gold typically offers strong intraday ranges relative to its spread.

Where can I practice financial spread betting on gold?

You can practice financial spread betting on gold by using a demo trading account loaded with virtual funds.

Many brokers like Pepperstone will also will give you live market prices on all assets, access to charts and news feeds so you can get a feel for how the gold market moves over time without risking your own money.

What size position is sensible when spread betting gold?

Asking what size positions is sensible and shows a good traders instinct.

Position sizing should come from your max acceptable £ risk on your trade and then be worked backwards.

Find your entry, decide on your stop loss and then work out the position size, so that if the trade was stopped out you would only lose the £ you had allocated.

Eg: £40 risk per trade, if the stop is 80 points away, your position size would be £0.50 per point. 0.50 x 80 points = £40

When is the best time of day to spread bet gold?

The best time of day to spread bet on gold is when you can give the market your full attention…

Good times are during the US stock exchange open: 14:30-21:00 GMT, as this is when you see a lot of price movement and liquidity.