December Stock Market Performance: Is It Really a Bullish Month?

What History Says About December Seasonality in the S&P 500

Home » December Stock Market Performance: Is It Really a Bullish Month?

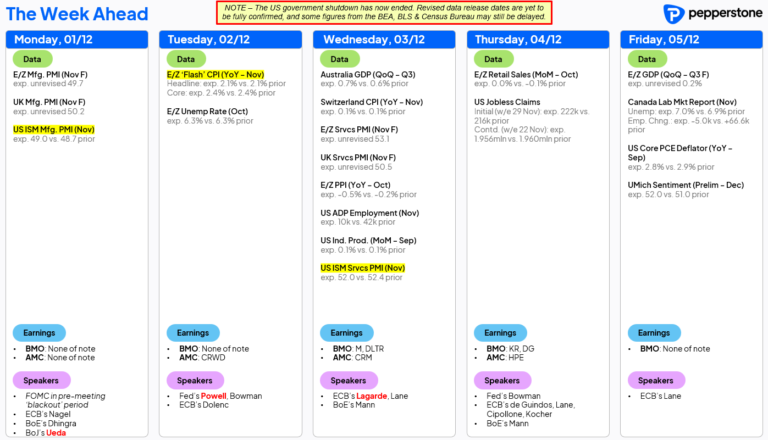

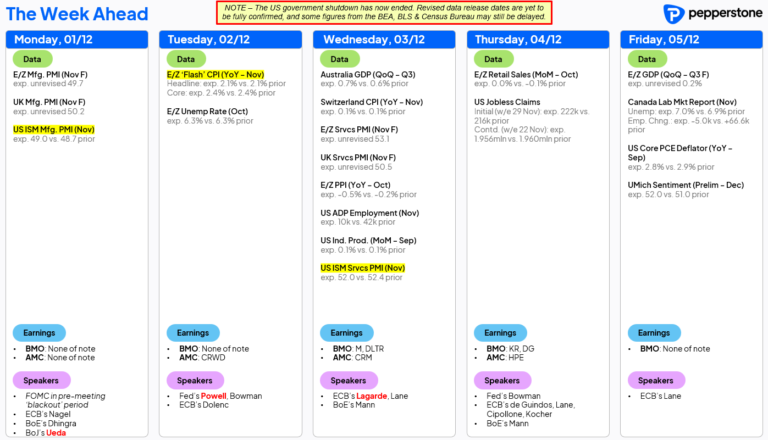

We’ve got quite a light schedule of data this week, bar a few central bank speakers…

So what does that mean for price action?

Well, it’s the first day of December, and if you’d believe the hype, that’s typically a bullish month for stocks.

But is it really?

Let’s look at the data…

DECEMBER BULLS?

When you zoom out and look at the last ten Decembers for the S&P 500, here’s what you get:

6 out of 10 years positive, with a few horrors in there too ![]()

![]()

(I also backtested more years, 32 to be precise, and the data was similar, 59% of December’s were bullish.)

So yes, technically bullish…

But not exactly a slam-dunk seasonal tendency.

(And no, this isn’t the Santa Rally, that’s a different thing, technically strength in the second half of December… more on that in a week or so.)

Anyway, as a reminder here’s how December 2024 played out, week by week:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Hourly chart of S&P over December 2024 below ![]()

![]()

And so coming into the end of 2025 it’s all about themes, right now it’s:

- AI Infrastructure Boom – Big capex themes still running

- “Is it a bubble?” – The debate’s heating up

- December Rate Cut – Odds now at 87%

- Trump Factor – “I’ll keep stocks at record highs,” he says

- JGBs on edge – Watching the Japanese bond market shake things up

Not to mention the tariff battles with China and all the military stuff going on!

Summary: The market will do what it wants…seasonality or not, if the participants are happy to hold risk, we’ll move higher.

All we can do is show up, look for our setups, manage our risk, and stick to the process.

That’s real edge…