Gold Trading Hours Explained: COMEX Settlement, London Fix, and Key Market Times

Before you trade gold again, know when the real action happens — and why timing can make or break your edge.

Home » Gold Trading Hours Explained: COMEX Settlement, London Fix, and Key Market Times

GOLD FACTS

![]()

![]()

This is the official daily settlement for gold futures.

It’s the price institutions use for margining, P&L, and risk models.

You’ll often see a flurry of action right before… then often a calmness after.

Think of it like the “closing bell” for the gold futures session, even though the market keeps trading.

![]()

![]()

In the futures market, trading pauses for one hour every evening. For “maintenance” (whatever that is ![]()

![]()

Useful to know if you’re holding overnight or managing stops around that time. (There’s some gap risk)

![]()

![]()

While not gold-specific, it matters, of course.

This is when macro flows hit… inflation data, dollar moves, risk-on/risk-off sentiment.

Gold often reacts to all this.

And don’t forget: ETFs like GLD, and options kick into gear during this time too.

![]()

![]()

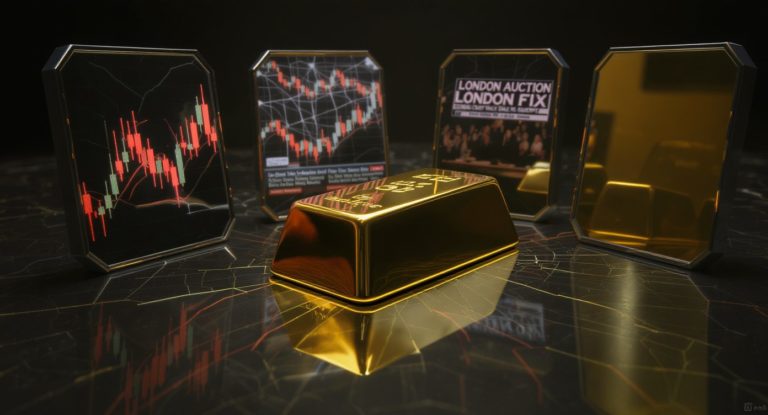

This is the “London Gold Fix” used by central banks and institutions dealing in physical gold.

“The London Bullion Market is the international home of gold pricing.

Twice a day — at 10:30 and 15:00 GMT — prices are officially fixed.”

The London Fix isn’t based on COMEX futures…It has its own physical auction.

But price often aligns closely, thanks to arbitrage and hedging across global markets.

So listen, this isn’t strategy or anything, but if you’re going to trade a market, it makes sense to understand how it works behind the scenes.

Now you know. ![]()

![]()