How to Trade An Intraday

Liquidation Event

What to watch for when a crowded trade finally unravels.

Home » How to Trade An Intraday Liquidation Event

Well, the precious metal train keeps on chugging. ![]()

![]()

Gold is entering “parabolic move territory.” (for a commodity at least)

So, what’s the potential play here?

WORKSHOP A GOLD TRADE

Now, personally? I think the swing trade setup is risky.

A blow-off top vs a liquidation event… both are options.

But I do think we’re due a huge intraday range day soon.

And that could create excellent short-term trading opportunities.

Let me think out loud here… this is not advice, of course, just how I might approach it…

Last Wednesday’s Drop

So, last Wednesday, we got a taste of what could happen when a crowded trade needs to unwind.

Almost as soon as the US cash session opened, Gold got smacked.

A hard sell-off, down $80+ with almost no bounce.

Now, of course, that turned out to be nothing on the daily chart this time, but the sheer volume and urgency give us a clue as to what to look out for next time. Right?

The move may well be violent, one way and ripe for short-side momentum trading.

But what we don’t want is to be the clown who shorts every ominous red candle in a runaway bull market, hoping for a reversal. ![]()

![]()

We want to be smart and build a database of clues that will give us the green light to start playing short-side momentum if we see it.

So, what were the clues?

#1 Urgency and Time of Day

Note the selling a few minutes after the bell (first arrow), aggressive selling, one-way street.

The tape shifted, volume was higher than normal, and bounces were sold quickly.

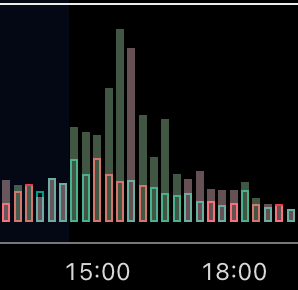

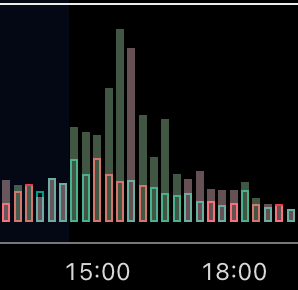

BTW, that volume indicator you see there is super handy for a day like this, it shows me the volume compared to the typical volume at that time of day ![]()

![]()

15m chart

The hollow box is the typical volume, the solid bar is the actual.

So, at a glance, you can see “hey, this is unusual, something’s different” and position accordingly.

I got it from here (free, just add it to your TradingView)

#2 Price Acceleration

Watch how price hugs the moving average on the way down…

No meaningful bounces, just driving lower.

Then… boom. It breaks the prior day’s low → accelerates even faster.

Textbook liquidation event.

Only when we got a decent range bull bar did things settle down…

Alright, so what’s the point of all this?

Well, I like to prepare, not predict.

I don’t know where Gold goes next… and I’ve been doing this too long to pretend I do. ![]()

![]()

But one thing I do know after 20+ years in this crazy business?

Rug-pull setups are rare…

…but when they play out, they can offer some beautiful trading opportunities.

So I like to prepare them in advance.

Because just blindly shorting in a vertical bull run is how accounts get mashed. ![]()

![]()

Could Gold keep grinding up? Sure.

Could it stagnate or drift lower? Yep.

But if it does panic flush one day?

Don’t just hope to catch it.

Be ready.

Because in this game, the edge often goes to the trader who already mapped out the play. ![]()

![]()