Spread Betting in the UK: The Complete Guide (2025 Edition)

Tax rules, trading strategies, and brokers — explained by a UK trader with 20+ years of spread betting experience.

Home » Spread Betting

Why This Guide Exists.

Spread betting has changed a lot since I first picked up the phone to get a quote on the FTSE over 20 years ago…

Platforms are slicker, spreads are tighter, and the range of markets is huge.

But one thing hasn’t changed… most new traders are still confused about how spread betting actually works, what the tax rules are, and how to approach it sensibly.

That’s why I put this guide together. To help get you up to speed with spread betting.

Not theory, not marketing BS, just the straight truth from someone who’s used spread betting accounts through every kind of market.

Here’s what you’ll get as you go through this page:

Old advice on how to call through your orders

Early spread betting order tickets

- A plain-English breakdown of what spread betting is (and isn’t)

- The exact UK tax position — with links to HMRC manuals and evidence

- Key spread betting trading strategies

- The differences between spread betting and CFDs

- How to get started with the right broker and platform

So, whether you’re brand new and weighing up your options, or already trading and looking to explore the tax benefits, I hope this guide will point you in the right direction.

Good trading!

Mark

Table of Contents

What is Spread Betting?

Ok, let’s start at the beginning, what the heck is spread betting?

I mean, the name doesn’t exactly help!…. betting on a spread?! Spreading your bets? Nope!

Think of it like this:

Spread betting is a simple way to speculate on financial markets without owning the underlying asset.

In other words, take a view on the short-term direction of a market.

Instead of buying or selling shares, futures, or forex directly, you’re placing a bet on whether the price will rise or fall.

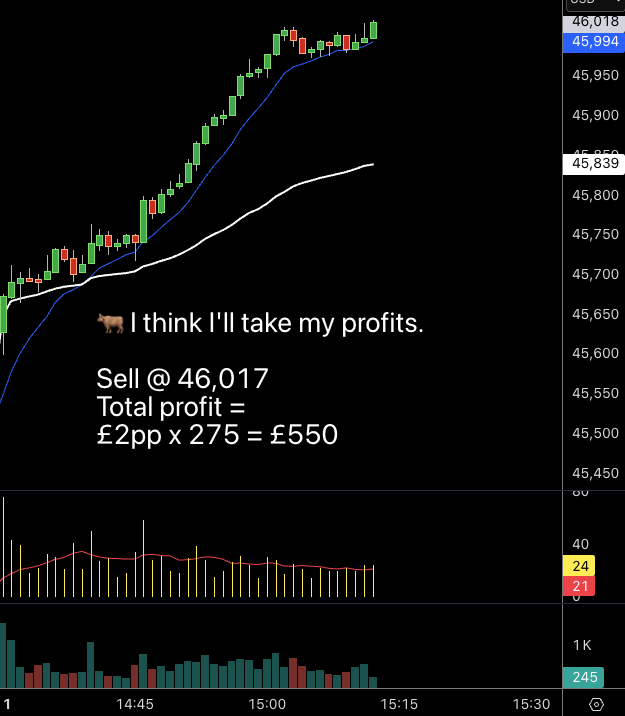

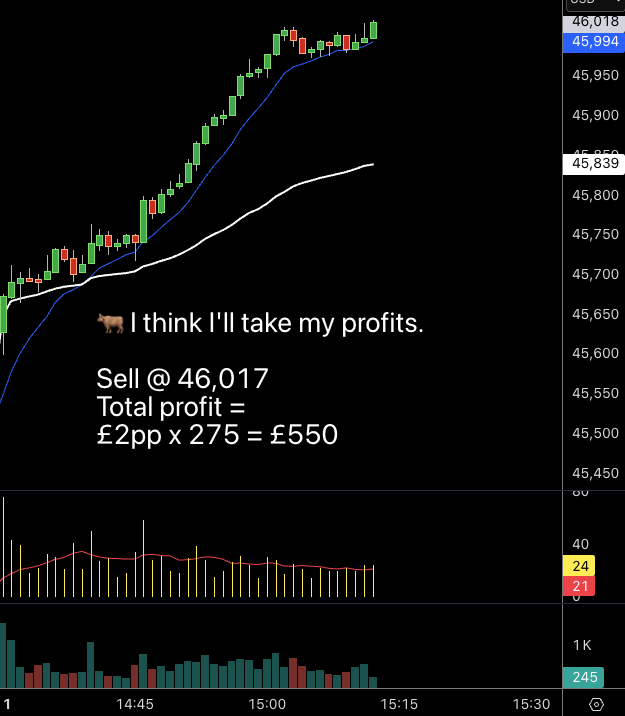

Example: Buying the Dow at £2/point. Each point = £2 profit or loss.

You think the FTSE 100 will rise over the next few days? You can spread bet on that.

Think the price of Oil will fall in the next five minutes? You can spread bet on that too.

The unique part?

Your profit or loss is measured in pounds per point; you only have to deposit a portion of the notional trade value (called margin or leverage), and the profits are tax-free.

This makes it an ideal trading vehicle for short-term traders.

So, for example, if you bet £10/point on the FTSE 100 rising and the index moves 20 points in your favour, you make £200.

If it moves 20 points against you, you lose £200.

Pretty simple, right?

This means small market moves can add up quickly — for better or worse.

That’s why risk management is critical when using spread bets.

So to summarise…

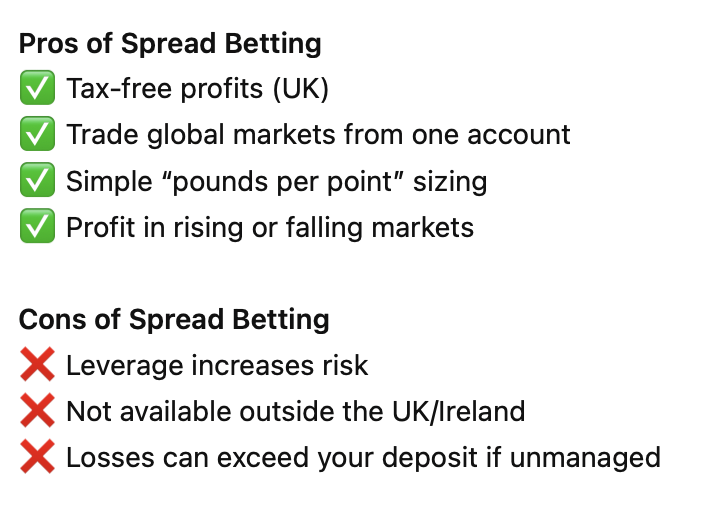

Key Features of Spread Betting

📊 Leverage: Control large market positions with a small deposit.

💷 Tax Benefits: In the UK, profits are free from capital gains tax and stamp duty.

🔄 Go Long or Short: Profit from both rising and falling markets.

🌍 Wide Access: Trade indices, commodities, forex, and shares all from one account.

💷 GBP Account: All trades are in pounds, no currency conversions

Spread betting is simple to understand, but there’s more to it than just pounds per point.

Next, let’s look at the platforms traders use and which brokers are best for UK traders.

Best Spread Betting Trading Platforms

One of the biggest advantages of spread betting today compared to when I started is the quality of platforms.

Back then, it was telephone quotes, massive spreads and if you were lucky, some basic and clunky dealer software.

Now, traders have access to powerful charting tools and slick broker platforms that make execution fast and analysis simple. Spreads are super tight, and it’s never been a better time to trade.

Popular Spread Betting Platforms

- MetaTrader 4 (MT4) – Forex focused, 90’s vibe but still popular!

- MetaTrader 5 (MT5) – An upgrade to MT4,

- CTrader – A day trader’s or scalper’s choice,

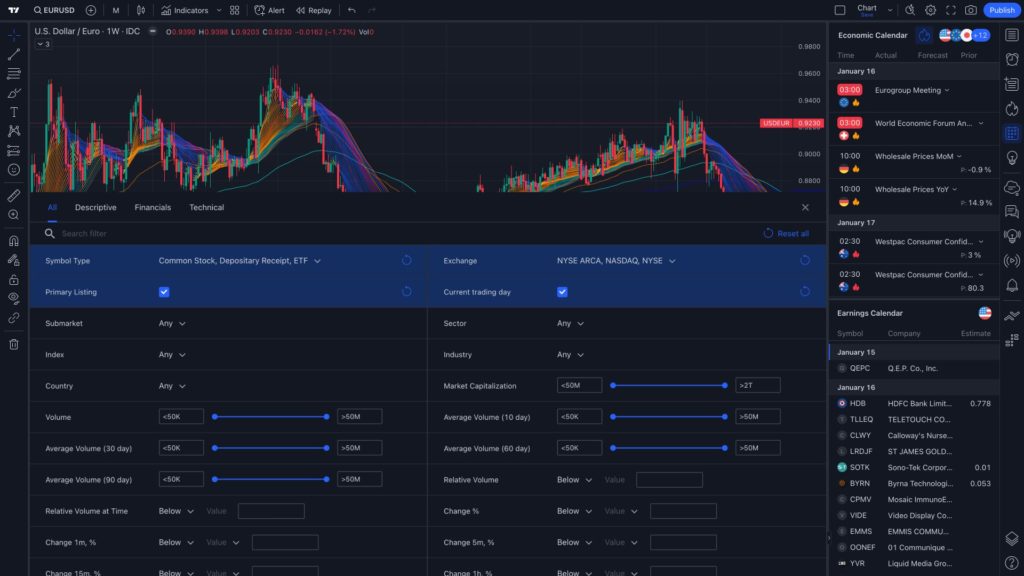

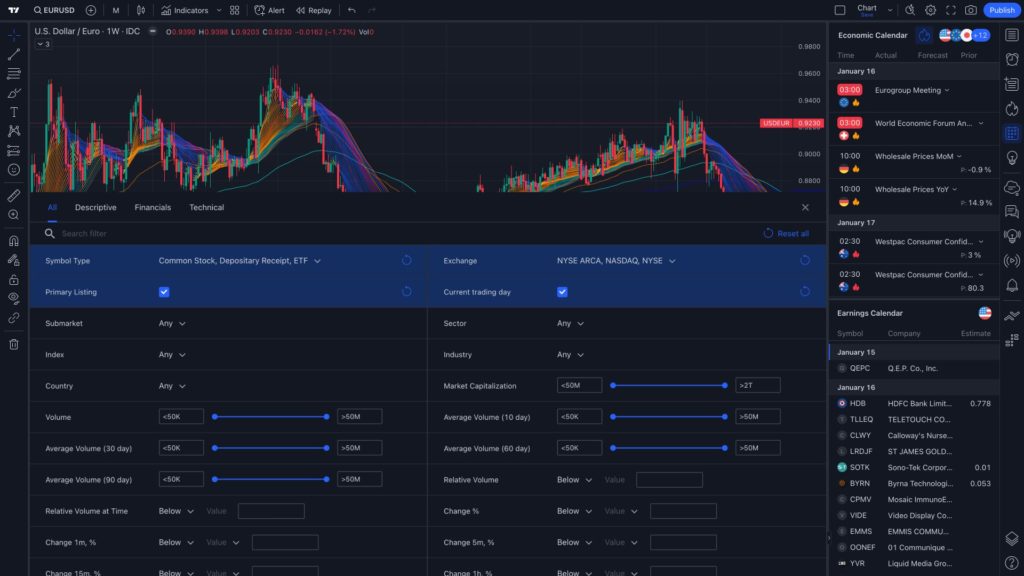

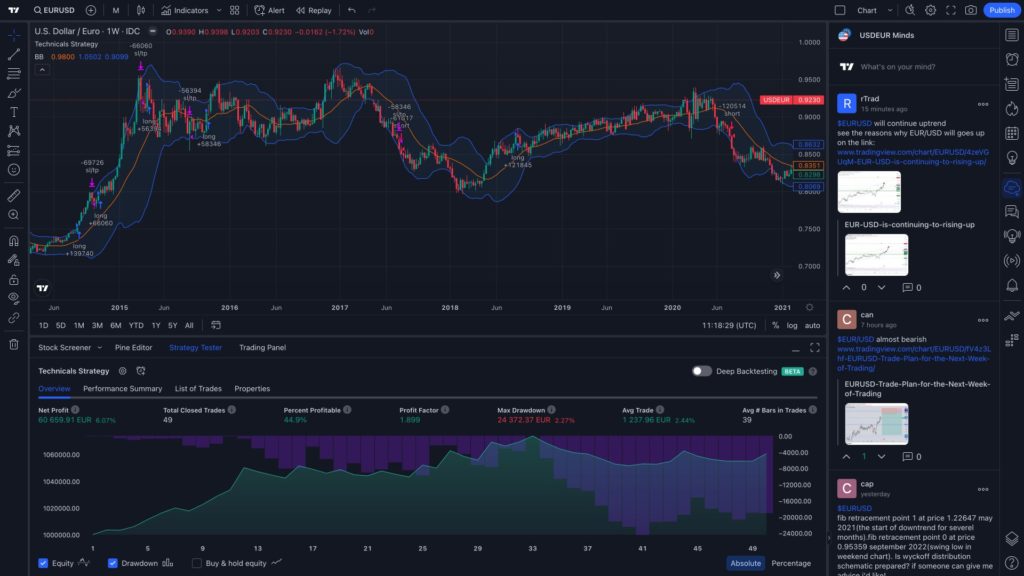

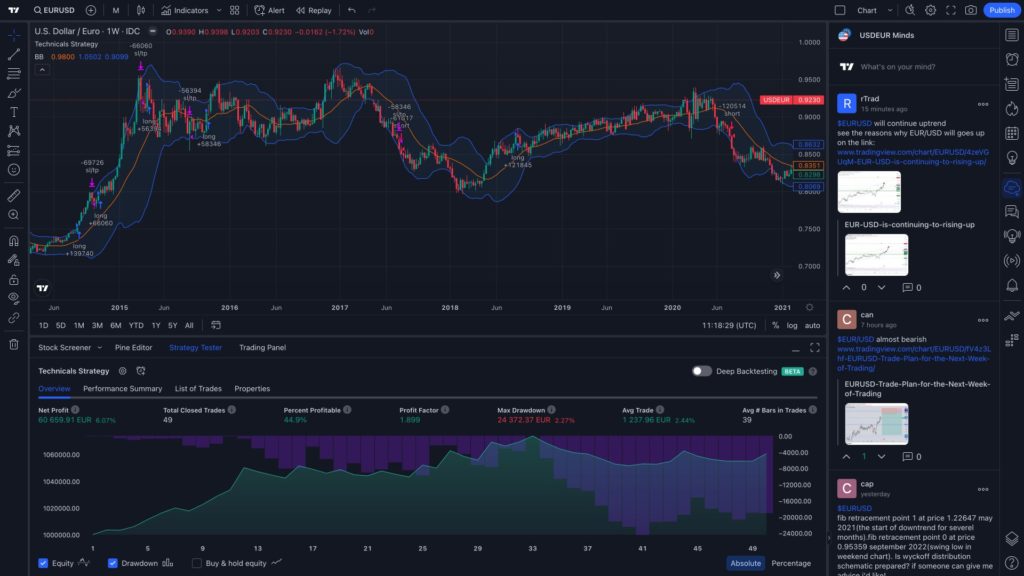

- TradingView – Modern, cloud-based, big community (best?)

- ProRealTime – Recently upgraded, good for analysis,

- L2 Dealer – Direct market access, used for UK shares. IG clients only.

Many brokers also offer their own proprietary platforms and apps, often designed to be beginner-friendly.

Here are some screenshots from TradingView below👇🏼

Why TradingView Stands Out

TradingView is fast becoming the go-to for serious traders. It offers:

✅ Clean charts with every indicator you could want

✅ Replay mode for backtesting your ideas

✅ Mobile + desktop access so you’re not glued to the desk

✅ The ability to share charts and setups with other traders

Some spread betting brokers even integrate directly with TradingView, meaning you can place live trades straight from the chart, which is a great feature. It means you can do all your analysis and execution in one place.

👉 I’ve written a full guide on spread betting with TradingView here: How to Use TradingView for Spread Betting.

Is Spread Betting Tax-Free in the UK?

The big one…for most UK traders, spread betting profits remain tax-free:

❌ No capital gains tax

❌ No income tax

❌ No stamp duty

That’s because HMRC treats spread betting as gambling, not financial trading — which is why it’s such an attractive option compared to CFDs or futures. 🇬🇧

HMRC’s own guidance (updated July 2025) confirms:

“No taxable gains or losses arise from spread betting.”

Exceptions are rare and only apply to businesses or unusual cases.

For day traders, scalpers, and swing traders, spread betting remains one of the most tax-efficient ways to trade in the UK.

⚠️ Tax laws can change, so always check the latest rules.

👉 Want the full research, with HMRC links, case law, and edge cases explained

Read my full guide here: Is Spread Betting Tax-Free in the UK? (HMRC Proof Included)

Spread Betting vs CFD Trading

Both CFDs and spread betting give UK traders leveraged access to global markets without owning the underlying asset.

The key difference? Tax.

✅ Spread betting profits are tax-free (no CGT, no stamp duty).

❌ CFD profits are taxable under capital gains rules.

So which is better?

• Spread betting → best for UK traders who want tax-free simplicity.

• CFDs → better if you need broader market access, hedging, or the ability to offset losses against gains.

👉 Read the full breakdown here: Spread Betting vs CFD Trading — Which Should You Choose?

How to Start Spread Betting (Beginner's Guide)

Getting started with spread betting in the UK is simple, but it pays to set things up properly from day one.

1. Learn the Basics

Understand how spread betting works: you’re trading in pounds per point, not buying assets. Small moves can equal big wins or losses. Good when trades are going your way, but risk happens fast!

2. Choose an FCA-Regulated Broker

Always go with a UK-regulated broker for safety.

• Tight spreads

• A solid platform offering (MT4, MT5, cTrader, or TradingView integration)

• Good support and clear fee structures

3. Start with a Demo Account

Most brokers let you practise risk-free.

Use this to learn how orders, stops, and position sizing work before risking real money. (take as long as you need)

4. Fund Your Account (Keep It Small)

When you’re ready, deposit only what you’re comfortable risking.

Remember, leverage magnifies both gains and losses.

5. Focus on Risk Management

• Set stop-loss orders

• Start small

• Avoid overtrading

6. Track and Review Your Trades

Use a trading journal (like Trading Plan Pro) to log your trades, strategies, and mindset. Over time, this becomes your edge.

Spread Betting Strategies

Once you’ve opened a spread betting account and learned the basics, the next step is building your trading strategy.

Spread betting works across indices (FTSE, DAX, Dow, Nasdaq), commodities (oil, gold), and forex — but the principles of good trading stay the same: clear setups, strict risk management, and consistency.

👉 Below you’ll find links to trading strategies that I think work well with spread betting.

Popular Approaches to Spread Betting:

• Breakout Trading – Explore the opening range breakout method

• Reversal Setups – Fade overextended moves intraday.

• Scalping the Open– Take advantage of small intraday moves.

• Gap Trading – Trading opportunities from market gaps.

• Trend Following – 10 Trend trading strategies for riding momentum.

You can also explore my general trading strategies here

Markets You Can Spread Bet On

One of the biggest advantages of spread betting is flexibility. From global indices to forex, metals, shares, and commodities, all can be traded from a single account, priced in pounds per point. That means no currency conversions or wondering what your true exposure is.

Popular Spread Betting Markets:

📈 Indices (FTSE 100, DAX, Dow, Nasdaq, S&P 500): Liquid, volatile, and perfect for day trading.

💹 Forex Major & minor FX pairs (GBP/USD, EUR/USD, etc.): 24-hour markets with tight spreads.

👑 Metals (Gold, Silver, Platinum, Palladium): Safe-haven assets with strong trends.

🇺🇸 US Stocks (Apple, Tesla, Amazon & more): Trade earnings, themes, and high volatility.

🇬🇧 UK Shares (BP, Barclays, Vodafone & more): No stamp duty, easy access to blue chips.

🛢️ Energy (Oil and Natural Gas): Volatile markets driven by global events.

FAQ: Markets for Spread Betting

Which market is best for beginners?

For most new traders, indices like the FTSE 100 are a good starting point. They’re liquid, widely followed, tight spreads and less volatile than, say the Nasdaq.

Which markets are most volatile for spread betting?

The DAX, Nasdaq, and Oil are known for sharp, fast moves. Great for experienced day traders, but risk management is essential. Things can get nasty very quickly! So make sure your risk management is on point.

Can you spread bet UK shares?

Yes. You can spread bet on companies like BP, Barclays, and Vodafone. A major benefit is that there’s no stamp duty on UK shares when spread betting.

Can you spread bet tech shares traded in the US?

Yeah, you can trade stocks like Tesla, Netflix, Google, Nike, Amazon and more using a spread bet. No currency conversions and a simple pounds per point directional bet.

What’s the most popular market to spread bet?

The Dow Jones and Nasdaq are among the most popular, thanks to their tight spreads and regular trading opportunities. Currencies like Euro vs US Dollar (EURUSD), US Dollar vs Japanese Yen (USDJPY), and British Pound vs US Dollar (GBPUSD) are also pretty popular amongst traders.

Can I trade commodities like gold and oil through spread betting?

Absolutely. Gold, Silver, Oil, and Natural Gas are all available. They go through periods of high volatility, which makes them attractive for momentum strategies when the conditions are right.

Choosing a Spread Betting Broker

Not all spread betting brokers are created equal. The right one can make your trading smoother, cheaper, and safer, while the wrong one can eat into your profits or even put your capital at risk.

Key Things to Look For:

✅ FCA Regulation – Only ever trade with a UK-regulated broker for protection.

✅ Tight Spreads & Low Costs – Small costs add up fast when you’re active.

✅ Strong Platforms – MetaTrader 4/5, cTrader, ProRealTime, or TradingView integration.

✅ Good Range of Markets – Indices, forex, commodities, and shares all from one account.

✅ Solid Support – Fast customer service when you need it most.

Some brokers even offer extras like access to educational trading webinars.

👉 I’ve used many brokers since I started spread betting over 20 years ago.

Pepperstone are a solid choice right now — FCA regulated, competitive spreads, and one of the few brokers offering direct integration with TradingView, letting you spread bet straight from one of the best charting platforms available.

📌 Check out Pepperstone here and open a free spread bet demo account to test them out.

Where To Go Next

If you’re hungry for actionable trading strategies, head over to my trading strategies page… packed with practical setups you can start testing right away.

Prefer learning visually? My trading webinars dive deep into strategies, psychology, and best practices.

Looking for timeless lessons? Don’t miss my trading wisdom page where I share trading quotes, ideas and strategies from years gone by.

And if you’re on the move, tune into the Traders Mastermind Podcast. You’ll find solo episodes, expert interviews, and the hugely popular Developing Trader series, available on all major podcast platforms.

Oh, and don’t forget to check out Trading Plan Pro if you’re after a simple but effective Google Sheet template to track your trades.

Good trading,

PS: If you like this type of content, you’ll love my daily email!