Why Traders Blow Up Accounts (And How to Stop It)

Find your decision point before tilt wipes you out.

“I keep blowing up accounts after good runs, and the psychology is killing me.”

Common problem. It’s the old trader saying amplified:

“Eat like a bird, sh*t like an elephant.”

Make steady progress, then torch it with one or two bad trades/days.

So, how do you fix it?

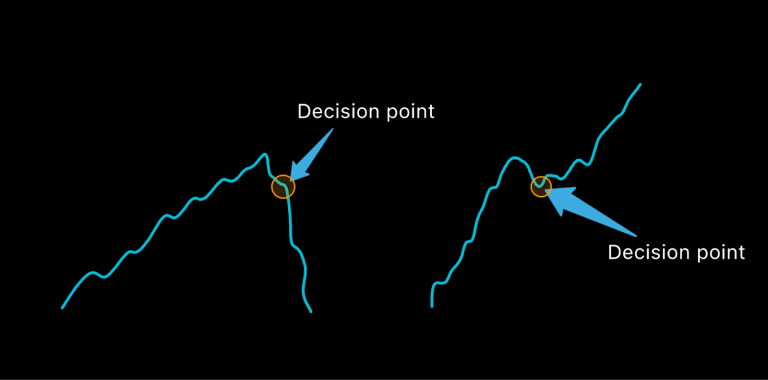

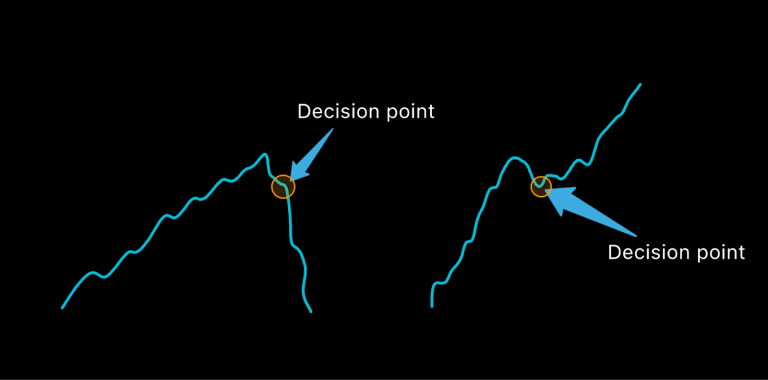

FIND YOUR DECISION POINT

The first step: figure out why.

You’re not blowing up because your strategy has a normal drawdown.

You’re blowing up because of too much size, too many trades, and the desperation to “get it back.”

But here’s the thing:

There’s always a decision point.

That moment on your equity curve where something flips in your brain.

Where you stop trading like you did on the way up… and start trading not to lose.

Your job is to find it.

Pull up the equity curves of every blown account.

Spot the inflection point.

Then go back through the blotter and look at the trades around it.

Chances are, the catalysts are the same every time:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

But when you’re in the heat of it, the emotion blinds you to the pattern.

Identify the decision point → and you’ve already won half the battle.

Then you can actually build the fix… and instead of blowing up, push the account back to highs…

Here are a few free resources that’ll help:![]()

![]()

![]()

![]()

![]()

![]()

Home » Why Traders Blow Up Accounts (And How to Stop It)