Is Spread Betting Tax-Free in the UK? HMRC Proof Included

Home » Is Spread Betting Tax-Free in the UK? HMRC Proof Included

The Tax Status of Spread Betting UK - My Research and Findings

So you’re probably here because you’re a British trader asking the question…

“Is spread betting tax-free in the UK”?

Surely that’s too good to be true!?

And then you start to think to yourself… well, why would I NOT trade via a spread bet if I’m in the UK?

Who wants to pay capital gains tax unnecessarily, right?!

I hear you.

Well, let me tell you this. Spread betting is tax-free, and I’ve got the evidence to back it up.

Why have I done this?

Because I wanted to see for myself when I started trading in 2001, and I like to make sure the rules haven’t changed since then!

Table of Contents

It IS tax-free… read on for the evidence from HMRC 👇🏼

First off, before we begin, let me tell you that I am a trader and have been for 24 years.

I am not an accountant or tax advisor, thankfully! (Sorry to the accountants out there 😁)

So, of course, please get proper financial advice on any tax planning… individual circumstances can differ. (You might have some weird trust, wrapped in an offshore shell company with unusual investment objectives going on…)

Secondly, the quick answer is yes, spread betting is tax-free. No capital gains, no stamp duty to pay.

But, in this article, I’ll show you:

- Evidence,

- Samples of court cases,

- Links from HMRC,

- Unusual edge cases.

So you can see for yourself.

I’m not here to advise, recommend, or tell a fellow trader how to structure his tax affairs… I’ll just show you the evidence and give you my opinion.

👉🏻 I’ll also include some info on how spread betting works, and compare it to other ways of trading like CFDs.

👉🏻 I’ll share some trading strategies you can look at, as well as trading platform options to consider.

👉🏻 Above all, I’ll give it to you straight from 20+ years in the game… no ‘maybe this, maybe that’ nonsense.

So whether you are a seasoned trader exploring spread betting to save on that tax bill or brand new to the trading business and curious, read on.

Is spread betting tax-free in the UK? And what exactly are the spread betting tax benefits?

I’ve spent hours researching HMRC manuals on trading, reading court cases and exploring different avenues to get a definitive answer.

Lucky for you, I’ve saved you all that work and distilled my findings below. 😁

Because let’s be honest, someone just saying “yes, don’t pay stamp duty or capital gains” isn’t really good enough.

You want to see evidence and proof, so you can make your own decision, right?

Spoiler alert – As of 2025, I think spread betting remains one of the most tax-efficient ways to trade for UK residents.

Let’s break it down and show you why I believe that…

Is Spread Betting Tax-Free in the UK? (Quick Answer)

Yes — for most UK retail traders, profits from spread betting are not taxed.

✅ No Capital Gains Tax

✅ No Income Tax

✅ No Stamp Duty

That’s because HMRC treats spread betting as gambling, not as trading financial instruments.

Let’s explore the evidence…

Why Is Spread Betting Tax-Free?

Under HMRC spread betting rules, no assets are bought or sold — it’s considered a bet.

A very short history lesson.👨🏫 (stay awake at the back!)

Spread betting was invented in the 1970s by Stuart Wheeler, as a way to bet on gold prices without touching the futures market.

His workaround? Frame it as a bet — a wager between two parties.

Today, spread betting is still structured this way: you’re not buying or selling anything — you’re placing a bet with a broker on whether a market will go up or down. (more detail with an example later)

HMRC’s own manual confirms this:

“Though the terminology used in spread betting frequently echoes that of the derivatives market, no assets are acquired or disposed of and no chargeable gains or allowable losses arise from spread betting.”

And just to be clear, that guidance was updated July 25th, 2025.

So we’re not looking at a hundred-year-old example law here, hoping it holds. This is a very recent article from the tax man himself telling us it’s exempt.

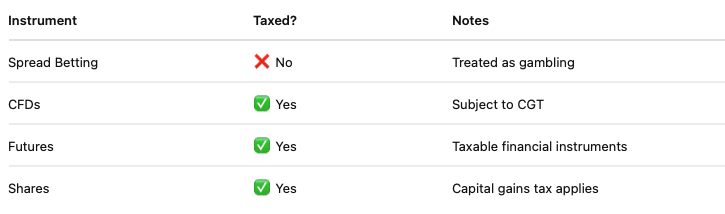

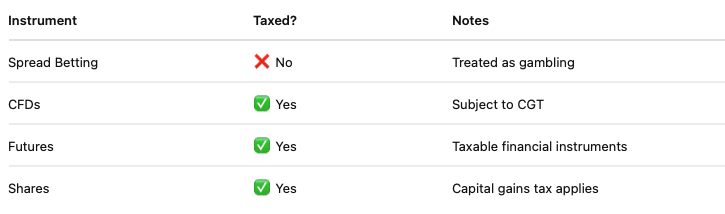

How Does Spread Betting Compare to CFD Trading, Buying Stocks, Futures or Forex? Any Capital Gains Tax or Stamp Duty?

Ok, so if you’re an active trader looking to speculate on markets like the FTSE, Nasdaq, or even Gold, there are several alternatives to using a spread bet.

But whichever you decide on, they are almost all wrapped up in the same tax status…

👎🏻 CFDs (Contracts for Difference) are taxable.

👎🏻 Futures are taxable.

👎🏻 Options and shares — typically the same story.

From HMRC:

“Retail contracts for differences are financial futures… TCGA92/S143 charges the outcomes under the capital gains regime.”

They even provide a worked example of CFD tax calculation here: CG56101 (sorry to bombard you with links, but I want to show you my research)

So, if you’re trading the exact same markets via CFDs or futures, you’re taxed.

But if you’re using a spread betting account? You’re not. 💰

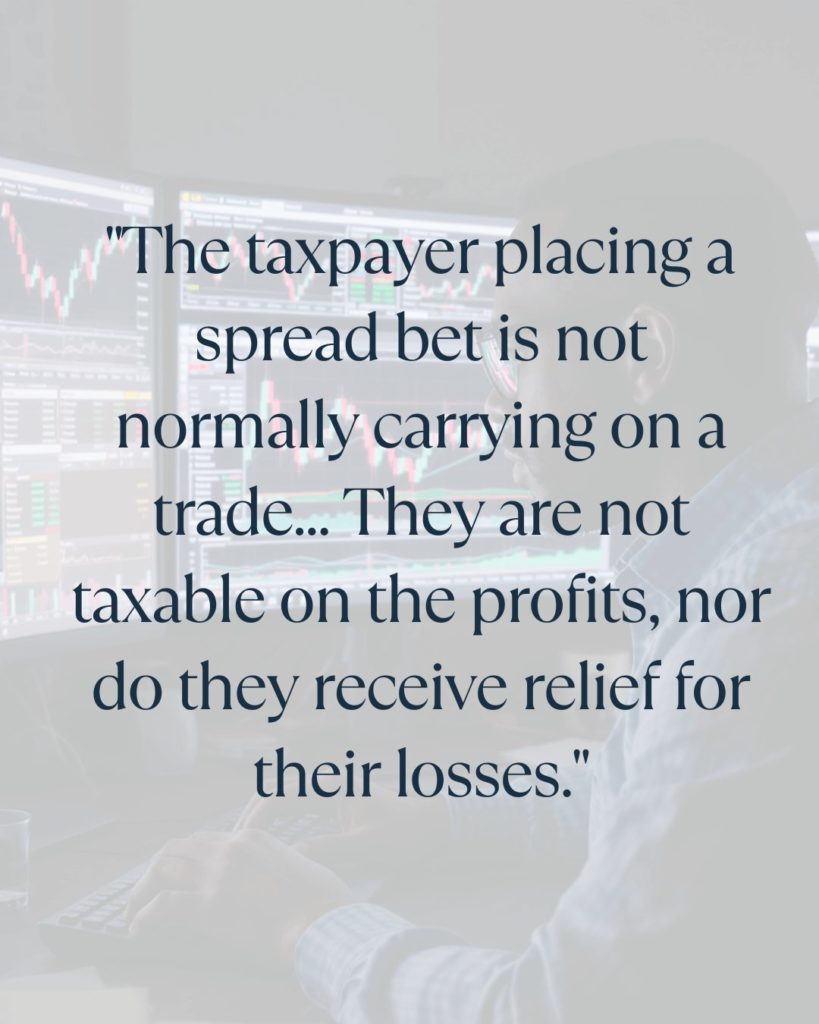

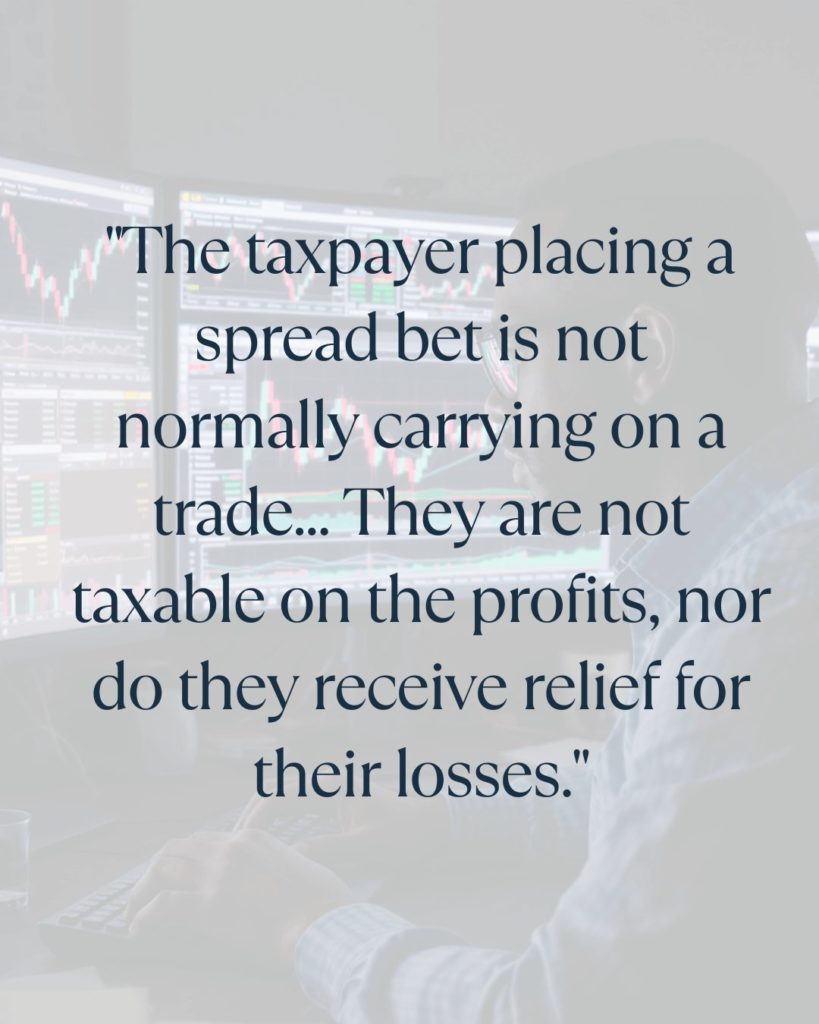

Is Spread Betting Ever Taxable?

Technically, it could be, under some weird edge case.

But for 99.9999999% of retail traders, these don’t apply.

HMRC says this:

“The taxpayer placing a spread bet is not normally carrying on a trade… They are not taxable on the profits, nor do they receive relief for their losses.”

What is Spread Betting and is it right for you?

Is spread betting the right trading vehicle for you?

This video I did many years ago might help with that. (but that thumbnail is the worst, I really don’t look like that, I’ve been stitched up!)

But, as we’re focused on the tax advantages of spread betting, the only time you might NOT want to trade with a spread bet and instead use a CFD is if you were hedging a portfolio.

Why?

Well, you may want to offset the losses on one against the gains on another.

Ok, let’s say you think the market is due for a few months of downside action and you short some FTSE.

You might prefer to choose a CFD vs a Spread Bet because that trade is a hedging strategy, part of a broader position. (which could go either way)

And you want to be able to offset the tax gain on one with the loss on the other.

The last thing you want is to lose money on the hedge and then not offset that loss against the gain in your portfolio!

eg: You lost 100k on a hedge, and made 100k on your portfolio.

You actually made nothing net net… but the tax man wants his slice of the 100k gain because a spread bet is treated as gambling.

Now, if you’re a trader using spread betting as a way to purely speculate on price movements, none of that is going to apply.

But hey, it’s worth mentioning.

Tax Status of Spread Betting According to HMRC

The tax status of spread betting is pretty clear, but there are a few very rare edge cases I found.

What HMRC and UK Case Law Say About Spread Betting Taxation

- You’re running a business where betting is part of the operation. (I mean, yeah, that’s super unlikely)

- You’re acting as a bookmaker or club owner, profiting from organising bets

- You’re using spread betting in a corporate structure for a broader trade

Example HMRC court cases:

👨🏻⚖️ Evans v FCT – Professional gambler case (Australia but it mentions UK court cases)

👨🏻⚖️ Burdge v Pyne – Club owner who profited from card games (UK)

👨🏻⚖️ City Index Ltd v Leslie – Case involving enforcement of spread bet contracts

‘There has been no decision of a court in Australia nor, so far as I am aware, in the United Kingdom where it has been held that a mere punter was carrying on a business.’ –

All interesting legal debates if you’re a legal nerd 🤓 — but I think, irrelevant to most traders like us using a spread betting broker to day trade the markets.

More here on HMRC’s definition of a ‘trade’

Full-time Trader - Is Spread Betting Taxable (ChatGPT answers)

Ah, the old “yeah but if you’re a full-time trader you need to pay capital gains tax on your spread betting profits” comment.

Make your own decisions, of course, but contrary to trading forum folklore and armchair experts, HMRC don’t seem to make any mention of frequency of trading, success rate, or anything else.

And you’d think HMRC would say “spread betting is tax free unless… blah blah blah”

I mean, as much as they are frustrating at times, they aren’t trying to intentionally mislead us taxpayers.

The only ruling I found remotely related to spread betting was a guy running a club and making money from card games…

But, to be sure, I took ChatGPT, pasted all the court cases in and asked its opinion.

This is what it said:

A good start, what else?

Ok – no becoming a broker, taking the other side of another persons bet and claiming it’s a bet yourself… got it, what else?

Final Verdict: Is Spread Betting Tax Free UK?

Here’s the slam dunk traders!

As of July 2025, HMRC is crystal clear:

“No chargeable gains or allowable losses arise from spread betting.”

✅ Spread betting profits are not taxed in the UK.

That’s why many short-term traders — especially day traders, scalpers, and swing traders — favour spread betting over CFDs or futures.

You get access to the same markets, the same leverage, and the same speed… but with no capital gains tax on your profits.

HMRC does not treat frequency, time spent, or consistency of profit as grounds for taxation — unless you run a business where spread betting is part of the operation.

Oh and if you’re still not convinced… I found this from HMRC – The Professional Gambler

Same story… “The fact that a taxpayer has a system by which they place their bets, or that they are sufficiently successful to earn a living by gambling, does not make their activities a trade”

In other words, even if you’re a trading god, with some mega system HMRC still treats you the same as the average trader. 😎

How To Start Trading

Alright, so you like the tax benefits and think you want to try spread betting.

Well, I have a load of resources for you to dig into. But before I share those, a serious note…

When you are leveraged trading or trading on margin, the risks do become amplified.

If you’re long in a rising market, it’s great… the margin works in your favour and the profits can be very attractive.

But take that same trade in a falling market and losses can get big fast.

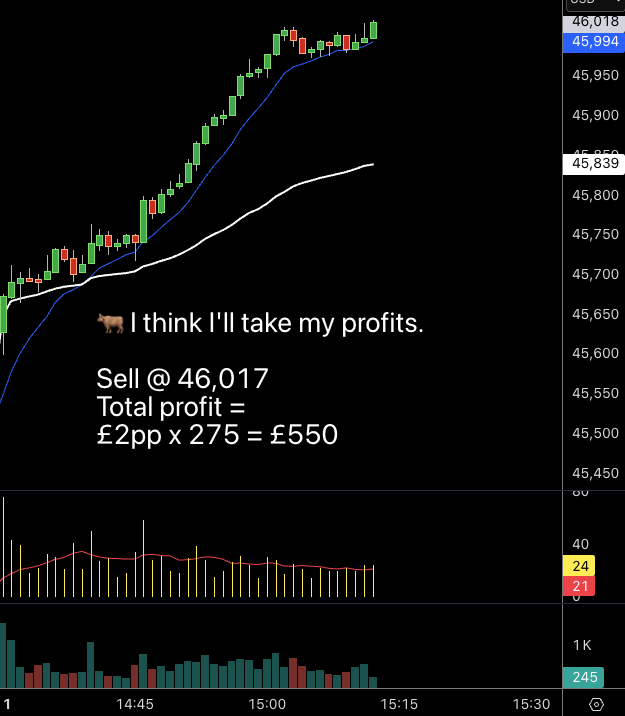

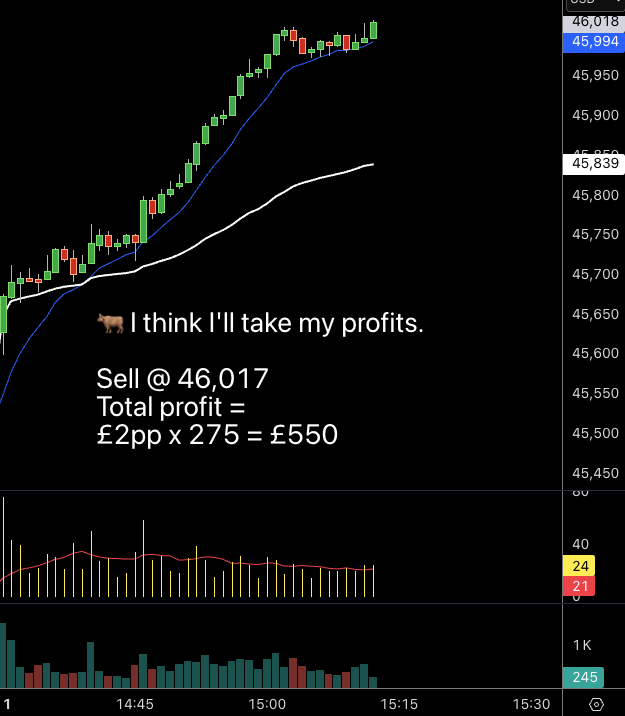

Look at these trade examples on the Dow Jones – Charts from TradingView

But, that’s the game right?

We are using an initial deposit to gain exposure to our preferred market, looking to potentially profit from a decent move; We don’t need to put up the full value in perhaps the traditional way of trading.

That amplifies the risks… but also the potential profit.

We can use risk management tactics like stop loss orders to lower the risk, but it can never be eliminated completely.

Ok? Ok.

Top UK Spread Betting Brokers (2025)

Right, now we’ve cleared up the tax status of a spread bet… let’s get down to which spread betting broker I think is the best today in 2025.

Now you’ve got a lot to choose from, and they all have fairly competitive spreads.

They offer similar platforms.

And honestly? You can’t really go wrong with any of the top five players.

These are all, in my opinion, trustworthy, good brokers. 👍🏻

But, I personally choose Pepperstone.

Why?

Well, I’ve been with them for years, I’ve visited their offices, been invited to awesome client motorsport days, and know a lot of the team that work there.

They try hard to give an excellent experience for traders. Keep spreads low, develop new platforms, and educate traders.

They are FCA regulated (very very important, you must never go with an unregulated broker, I’ve heard stories from traders who lost everything going unregulated!)

And other traders like them too…

So that’s currently my preferred spread betting broker for 2025.

And they are actually offering free Trading View subscriptions for all new clients. (a nice extra)

You can use this link here to claim > Free TradingView or tap the banner below.

Remember you can always try a free demo if you’re not ready for a live account yet.

Benefits of Spread Betting (Beyond Tax)

Ok, so are there any other benefits to spread betting?

Yep…

- No stamp duty

- Flexible sizing: £0.01/point to £1,000+/point

- Simple leverage structure

- Access to global markets 24/5

- No actual asset ownership = faster execution and lower fees

- Single currency and simple trade planning. It’s pounds per point, and all profits are in GBP

- Profit potential from both rising and falling markets

- Clear cost structure. You pay the spread and no commission.

Alongside its tax-free status, spread betting also offers flexibility, fast execution, and access to global markets, making it a popular choice for UK traders.

That’s why tens of thousands of us British traders choose to spread bet!

You can click to check out my mega guide to spread betting.

Or if you want to explore some > spread betting trading strategies

Want to learn more about trading in general? My webinars and trading podcast are a good place to start…

FAQ

Q: Is spread betting gambling

A: Technically, yes — and that’s why it’s not taxed. But serious traders use it daily because it behaves just like a trading account.

Q: Are spread betting profits taxable in the UK?

A: No, not for typical UK traders using personal accounts. Rare business-related exceptions may apply. See above.

Q: Can HMRC change the rules?

A: Yes, tax laws evolve — but as of July 2025, the official guidance hasn’t changed in years.

Q: Could HMRC make a specific ruling for me?

A: I mean, yeah, they could right? HMRC can do anything, but you’d be the first, and traders have made millions from spread betting before you!

Q: Is there a 2025 spread betting tax update?

A: Yep, HMRC changed pages related to spread betting on the 25th July 2025.

Q: What’s the latest HMRC spread betting guidance?

A: It’s a bet, it’s free from tax.

Q: Can HMRC ever investigate my spread betting profits?

A: If you’re a typical trader, then you’re just gambling in the eyes of HMRC. If you’re running a fund, or doing something you shouldn’t, then yeah, maybe expect a knock on the door!

Q: Is spread betting better than CFDs for tax purposes?

A: Yes – easily. CFDs are taxable under current capital gains rules. While your spread betting profits are currently tax free for UK residents.

Q: Is spread betting tax-free if I live outside the UK?

A: Ah no, the tax free treatment only applies to UK residents. Sorry!

Q: Could the tax treatment of spread betting change?

A: Yes, future tax law can change (as we know!). It is possible the current government decides to change the spread betting tax law and tax winnings, but then what do they do about losses?

We could speculate all day but as it stands, it’s tax free.

Q: Do you have to declare spread betting to HMRC?

A: No, you’re just gambling according to the rules, just like you don’t declare a punt on England winning the World Cup. Or a few quid in the fruit machine.

Q: Can you make a living from spread betting?

A: Yeah – some traders definitely have. But expect a learning curve… anything worthwhile is going to be tough, right?

Q: Is spread betting legal in the UK?

A: Yes, perfectly legal and highly regulated by the FCA. All above board and legit.

Q: What is the best spread betting account in the UK?

A: Subjective, depends on what best means to you. But for tight spreads and a nice selection of markets and platforms to use, I like Pepperstone.

Q: Are CFDs tax-free?

A: No, unlike a spread bet, CFDs are a taxable asset.

Q: Which trading account is tax-free?

A: Spread betting accounts are tax-free, ISAs are a bit different, but of course have some tax advantages.

Q: How to avoid tax on trading in the UK

A: Spread bet! You know this answer by now 😁

Q: Do day traders get taxed in the UK?

A: Yes, unless they spread bet. If you’re trading any other vehicle, like futures or stocks, you need to either fill out a self-assessment and fill out a tax return or set up a company and do it that way.

Q: When does spread betting become taxable?

A: Almost never. Not even if it’s your main source of income.

Q: What about if I’m a trader from another country other than Great Britain?

A: I know the rules differ by country, so you’ll have to get specific advice for where you live.

Q: How do spread betting companies make money?

A: They essentially aggregate all the traders’ flow, make the spread and hedge any exposure they don’t want.

John goes long £10pp FTSE, Bill goes short £5pp, Jack goes short £5pp. The broker makes the spread plus any overnight holding charge.

Useful Resources on Spread Betting and UK Tax Rules

That wraps it up — straight from HMRC guidance, case law, and my own research.

Trade smart. Stay sharp. And enjoy those tax-free gains… while they’re still legal.

Hopefully, that puts it to bed once and for all!

Now you can focus on your trading 😎

Don’t forget to check out Pepperstone.

📩 Want to stay updated if HMRC’s position ever changes?

Join my free daily email for traders.

You’ll get strategy tips, tools, and alerts if anything changes in the tax landscape. 👇🏼