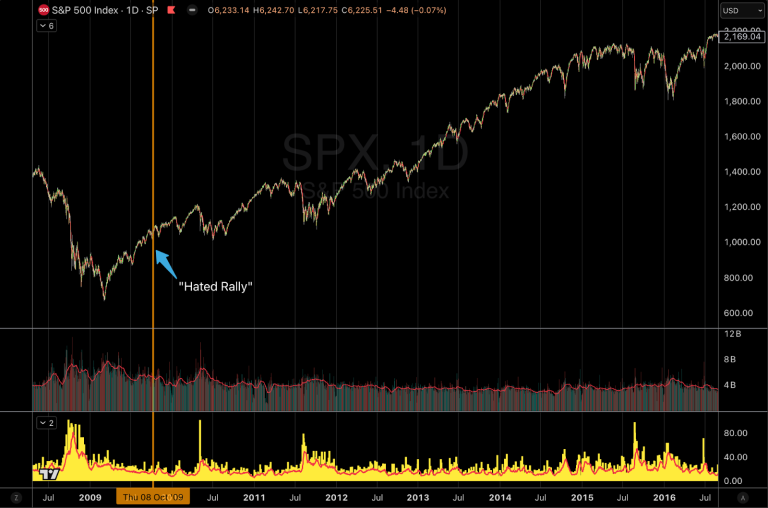

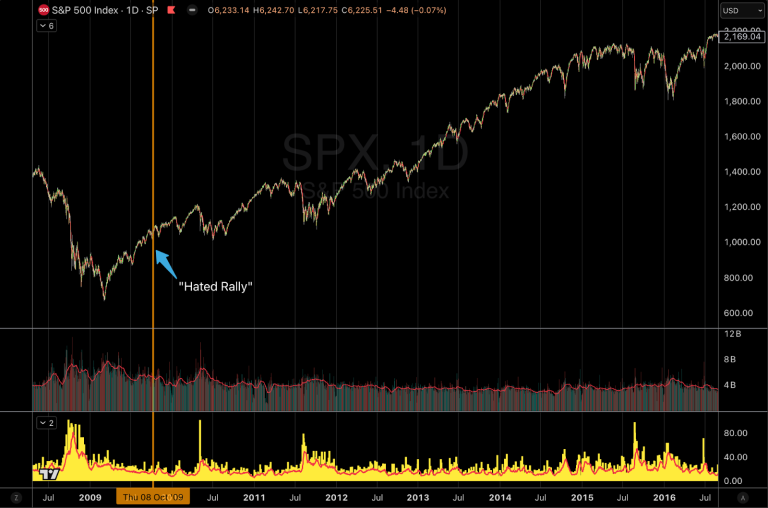

The Most Hated Rally in History (Again): Why It Keeps Happening

Traders hate it, analysts hate it, but the market doesn’t care.

I saw an article the other day that said:

“The most hated V-shaped rally just won’t stop.”

(Talking about the US stock market.)

And I thought… hang on, I’ve heard that phrase before…

THE MOST HATED RALLY

Sure enough, a bit of digging and yep… déjà vu:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

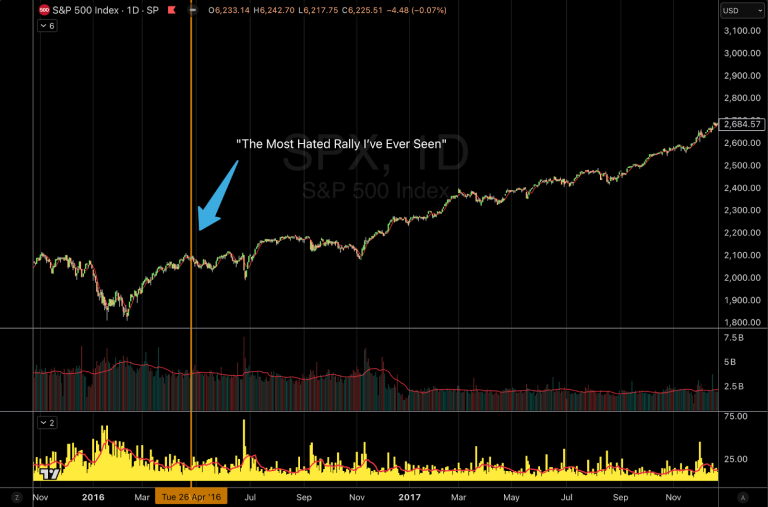

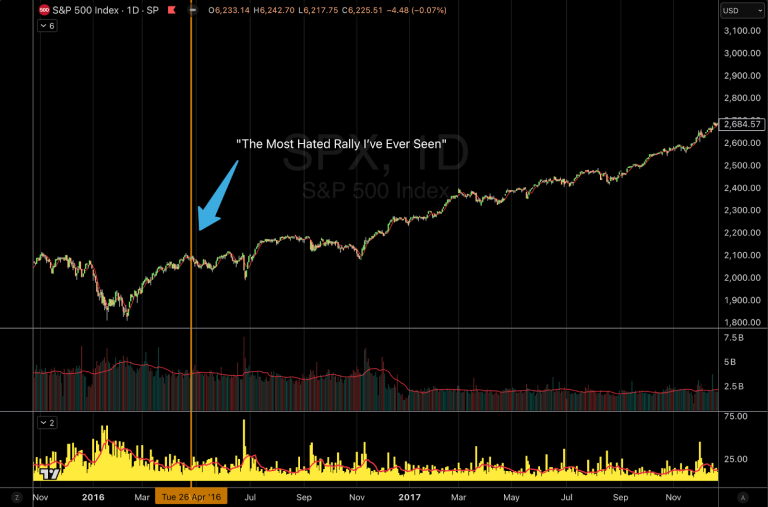

See the pattern?

The market didn’t give a sh*t who hated it. It just kept going.

And why do people hate rallies anyway?

- It defies logic or fundamentals

- Analysts can’t reconcile it with PE ratios or recession fears

- It feels like a bubble

- Everyone’s expecting a collapse

But the main reason?

When Wall Street hates a rally, it usually means they’re lagging the benchmark… and hating every damn minute of it!

And that brings us to today:![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

So… is this time different?

Maybe.

Probably not.

Does it matter?

Nope.

If the market keeps climbing, as traders we keep buying dips, playing support, riding the wave.

If it rolls over, great… we all love a clean short!

Either way, the lesson’s the same:

![]()

![]()

And “hated” doesn’t mean “over.”

Because let’s be honest…

They have to buy it.

Not because they love it, but because God forbid they miss the move while everyone else rides it higher.

Far better to be wrong with the herd than be the only genius who sat out and got fired for underperformance.

“Yeah, boss, I didn’t buy the rally because I hated it.”

Cool story bro. Clear your desk.

Clear your mind. Trade what’s in front of you.

Home » The Most Hated Rally in History (Again): Why It Keeps Happening